FY2023

City of Tallahassee Annual Budget Report

Mayor and Commissioners,

It is my pleasure to submit this balanced budget for Fiscal Year 2023 (FY23). As City Manager, I am optimistic for the future of our community and this organization through your leadership and direction. This balanced budget reflects significant public involvement throughout the budget development process, clear City Commission direction on future priorities through the City’s Strategic Plan, and dedication to our Mission, Vision, and Organizational Values.

The City of Tallahassee continues to be a national leader in the delivery of municipal services with additional investments in our workforce while also adapting to inflationary market pressures and an increasingly competitive labor market. Sound leadership and a dedicated workforce have helped us achieve our strategic priorities. Our commitment to continued success is reflected in this balanced budget as we enter the fourth year of our Five-Year Strategic Plan, including:

- Investing $227.7 million in our community with infrastructure, human services, and housing needs.

- Ensuring we are the employer of choice in an increasingly competitive labor market with a 5% across-the-board increase, with a $2,500 minimum for employees earning up to $50,000.

- Remaining an attractive community for families and businesses by maintaining a 4.1 millage rate for the seventh year in a row.

- Delivering $75 million of cost avoidance to utility customers through effective fuel price management (Oct 2021- Sept 2022) and potential total cost avoidance of $212 million through 2024.

- Balancing the budget using federal, state, and local resources and coordinating with partners to maximize efficiency and effectiveness in the delivery of services.

- Funding new community priorities to address gun violence, support the Riley House Museum, provide startup funding for a Commission on the Status of Men and Boys, additional funding for the Commission on the Status of Women and Girls, and expanding the Tallahassee Emergency Assessment Mobile Unit (TEAM).

Our mission propels us to a bright future, channeling our focus toward the objectives in the Strategic Plan as informed by your priorities: economic development, impact on poverty, organizational effectiveness, public infrastructure, public safety, public trust, and quality of life. The FY23 budget provides the path to continued success, with collaboration and community involvement and the ability to address the challenges of inflation, affordable housing, mental health services, and public safety.

IMPORTANT FEATURES OF THE BUDGET

Strategic Plan Achievements and Investments

Under the direction of the City Commission, we have met or exceeded key targets outlined in the Strategic Plan. This has been accomplished by, among other investments, increasing our annual investment in infrastructure and community needs with funding in capital projects, human services, and housing needs. Additional community needs and quality of life objectives have been addressed by reconnecting disconnected youth, incorporating mental health services in public safety response, investing in our neighborhoods, and increasing the inventory of affordable housing, among other accomplishments.

Within the last five years, we have invested approximately $4.3 million to engage with at-risk youth and now budget $1.3 million annually for these services. Since adopting the Strategic Plan three years ago, the TEMPO Program has engaged roughly 1,900 disconnected youth, which is 95% of the Strategic Plan target of 2,100 individuals.

We also remain steadfast in our commitment to funding human services programs for City residents through the Community Human Service Partnership (CHSP) program. The annual budget for CHSP in FY23 is $5.6 million, including $3.3 million from the City and $2.3 from the County. The City’s portion is an increase over $2.6 million from the previous cycle. During the last fiscal year, programs funded through CHSP served over 62,000 residents, employed 1,900 full-time individuals, and reported $200 million in economic activity.

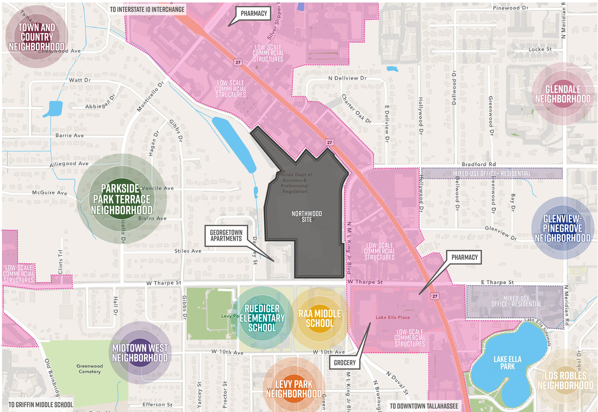

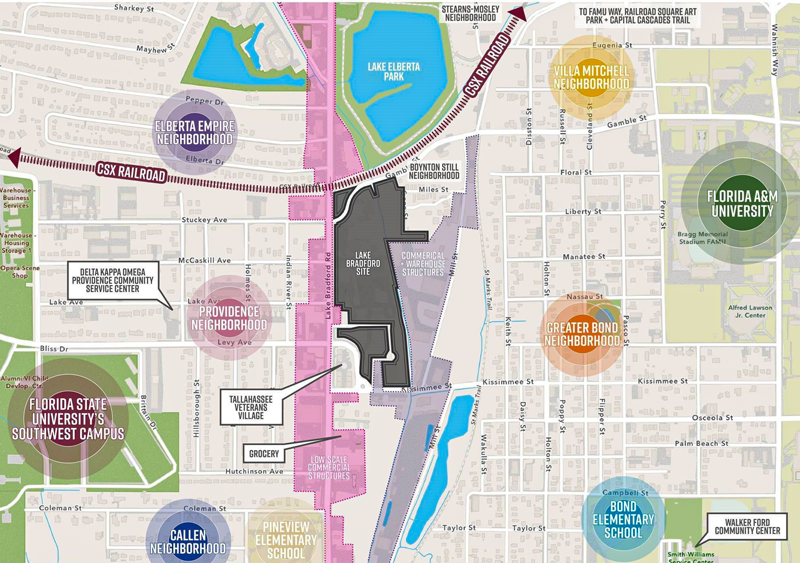

The budget also supports our strategic plan goal of ensuring residents are well-connected by an efficient public transit network supported by well-connected roads, sidewalks, and public transit amenities. Major infrastructure investments in FY23 include the completion of Weems Road and its mixed-use trail, FAMU Way Phase 3, and the groundbreaking of new roadways, sidewalks, and bike lanes, including Railroad Avenue, Zillah Street PASS, and Richview Road PASS. We will also continue planning efforts for a Public Safety Campus, a planned Fire Station at Lake Bradford Road, and Northwood Mall property, all of which will be designed and developed with community input to ensure a long-term community needs are prioritized. The maintenance of existing roadways and sidewalks to enhance the City’s transit network is also a priority in the upcoming FY23 budget.

Our affordable housing programs and initiatives include $21 million invested over the past five years, with an additional $9.7 million in American Relief Program funding in FY23. These programs have facilitated 626 house rehabilitations, 217 houses constructed, and 143 housing down payment assistance grants. With recent policy updates for multifamily development incentives, infill construction loans, a landlord risk mitigation fund, and an inclusionary housing ordinance, the City now has an additional 1,900 affordable housing units, in the planning and development process, compared to an average of 50-100 a year. Most existing inventory and new units in progress are targeted at households earning 60% or less of the area median income (AMI).

We have also continued to invest in people to maintain the City’s status as an employer of choice. The City maintained an excellent level of service during the COVID-19 pandemic thanks to the tireless efforts of our City team, our ability to innovate and drive process improvements and maintain our consistently strong financial management practices while increasing staff pay. Staff continues to advance the City Commission’s priorities in the face of inflationary pressures, slow revenue recovery, and increasing demand for existing and new services.

The City has faced new challenges and opportunities over the past few years and continues to deliver best-in-class service. Our team adapted continuously to find new ways to serve Tallahassee and remains committed to being the national leader in delivering public service.

Remaining an Employer of Choice

The City remains committed to investing in its greatest asset, its employees. However, the labor market is changing and becoming increasingly competitive. In recognition of these shifting market forces and the desire to attract and retain the best talent, staff proposes the recommended pay plan outlined below:

- A 5.0% across-the-board base pay increase, with a guaranteed minimum increase of $2,500 salary for employees earning up to $50,000, the latter impacting 41% of the workforce and providing up to an 8.0% raise for some.

- From FY21 to FY23, the City has reduced the average share of health plan costs for employees from 30% to 20%, and increased FlexBucks by 9% for an average of $1,153 more in take-home pay for those with family health plans.

- Scheduled pay increases for Police and Fire, as outlined in their respective Collective Bargaining Agreements.

As noted above, Florida’s labor market continues to recover from the impacts of the COVID-19 pandemic and react to changing market forces. According to the Florida Department of Economic Opportunity, private industry wages have increased 10.8% from March 2020 to May 2022. Labor force participation continues to recover compared to last year (59.1% versus 58.2%), and is nearing pre-pandemic labor force participation rates (59.4%), adding to hiring challenges felt by many employers. The local unemployment rate decreased to 2.5% in May 2022, down from 4.2% one year ago and below May 2019’s rate of 3.1%.In this increasingly competitive environment, the City is committed to managing inflationary pressures in order to attract and retain employees.

Economic Development and Community Affordability

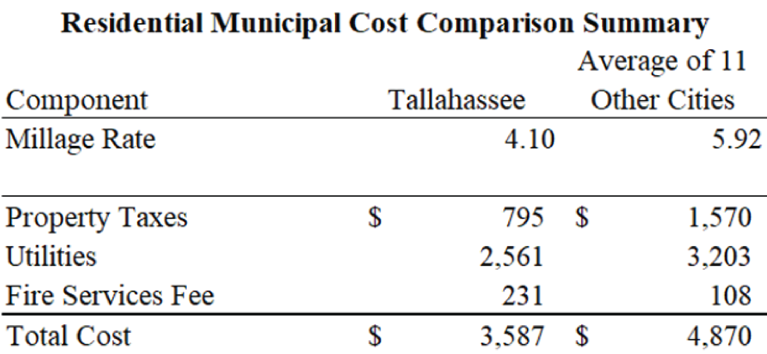

Our community remains an attractive home for both residents and businesses seeking affordable and efficient service delivery. Staff annually develops the Municipal Cost Comparison (MCC) to review the costs in taxes and fees for core services charged to residents and businesses in Tallahassee compared to 11 other cities in Florida. The comparison for FY23 shows that Tallahassee is the most affordable for residents and the most or second most affordable in each of the three business categories. The comparison cities were chosen based on similarities in size, percentage of taxable property, and scope of services provided to Tallahassee. The comparison uses property taxes, utility fees, and fire services fees for residents and also includes occupational licensing fees for businesses. A summary of the residential comparison is below:

In keeping property taxes affordable, Tallahassee has the lowest ad valorem rate (4.10 mills) compared to the 11 other municipalities (averaging 5.92 mills), 44% lower than the average. The City also has the lowest or second-lowest costs for all businesses across industries: barbershops, coffee shops, and offices.

The City of Tallahassee also is the most cost-effective option for electric ratepayers. While an inflationary energy market will have consequences for the General Fund regarding gasoline prices, the City’s electric and natural gas utilities have employed a proactive hedging strategy that has already prevented escalating electric bills for our customers and will continue to keep the price stable in the future. The City has hedged gas prices significantly lower than the current and projected market price.

This approach stabilizes prices and avoids significant costs for consumers amounting to roughly $53 million during the first three quarters of FY22. Additionally, current projections through 2024 indicate future cost savings of roughly $134 million. The average residential customer will pay $106 per month, compared to $154 per month on average for other Florida communities.

Furthermore, the City of Tallahassee is the only entity that does not charge an occupational license fee for its businesses and local economy. The City Commission repealed the fee in FY16, leading to an annual savings of at least $2 million for local businesses.

Financial Sustainability

As required by state law, we must adopt a balanced budget each year for all of its operating funds. The FY23 General Fund faces unique challenges from the accumulation of COVID-19 pandemic revenue loss, labor market pressures, increasing inflation, and continuous expansion of services. Despite these challenges for the past two years, the City has maintained and increased service delivery, preserved its workforce, and continued advancing toward the 2024 Strategic Plan goals.

The total FY23 operating budget is $826.8 million. Of this total, the General Fund budget is $184.1 million, holding the City’s proposed property tax rate constant at 4.1 mills. Our millage rate is the lowest of the 25 largest cities in Florida and has been unchanged for seven years. The FY23 capital budget totals $205.4 million and maintains a sound investment in our utilities and community assets. The total FY23 operating and capital budget is $1.0 billion, 0.4% less than in FY22.

This budget closed the previously anticipated $4.76 million General Fund deficit through several changes:

- A 10% reduction in road resurfacing expenditures, from 50 to 45 lane miles, in FY23. This would reduce expenses by approximately $445,300 while maintaining a commitment to resurfacing more lane miles than in the years prior to 2018.

- A 20% reduction in General Fund sidewalk capital projects in FY23 will reduce expenditures by $120,400. This would not impact operations related to the maintenance of existing sidewalks or repairing trip hazards.

- Ad valorem tax revenues to the General Fund will increase by approximately $2.4 million.

- An increase in the assumed vacancy factor for the General Fund in FY23, from 3% to 3.5%, will reduce budgeted personnel costs by approximately $540,275.

- American Rescue Plan Act (ARPA) funds have been used to support the public health response to the pandemic, replace lost revenues, and support the community in addressing the negative economic impacts of the pandemic. Accelerating the use of $1.1 million ARPA funds from FY24 to FY23 will close the final gap.

The General Fund will likely remain under pressure in the out-years and will require close monitoring during the FY24 budget development cycle.

Market Adjustments to Fees and Rates

City Commission Policy 224 requires that the City fully recover the cost for programs and services benefiting specific users. On this basis, the City reviews fees to ensure they fund necessary operating costs, capital outlay, and facilities maintenance as appropriate and are reasonable compared to other potential service providers. Rates for the City’s utilities are reviewed on a rotating basis and ensure they can meet revenue requirements needed to fund operations and investment into the replacement and restoration of critical utility infrastructure.

The following fee and rate studies are underway:

- Building Inspection Fund – A review of building and permitting fees, which have not increased since 2009, is currently underway to address rates and ensure revenue requirements are met. Recommended changes to these fees will be presented before adopting the FY23 budget.

- Fire Fund – The City and County executed a fifth amendment to the Interlocal Agreement Regarding the Provision of Fire and Emergency Medical Services as adopted by the City Commission on September 22, 2021. The prior fire services fee study identified an increase in rates of 15% in FY22, followed by 1.5% in FY23-24. The interlocal agreement directed the Fire Department to conduct a joint fire services fee study and present recommendations during the FY24 budget development process.

- Gas Fund – A rate study for the gas utility is underway, and rate recommendations will be presented before adopting the FY23 budget. Projections confirm a base rate increase of 5% based on CPI as budgeted in FY23.

- Parks, Recreation, and Neighborhood Affairs – Consistent with City policy, recreation fees are reviewed annually to ensure full recovery of costs and that they are reasonable compared to other potential service providers. Fees may be waived or reduced for eligible participants, such as youth unable to participate in recreational activities due to their inability to pay or other demonstrated financial need.

Furthermore, staff is forecasting another General Fund deficit in FY24, even when including $5.2 million ARPA revenue loss funding. Additionally, all ARPA funds will be exhausted before FY25. These projections emphasize the need to take a long-term perspective for balancing the budget and maintaining the health of the General Fund in the out-years.

Funding New Commission Priorities

With your leadership, we have also increased our investment in public safety, neighborhoods, CHSP, and affordable housing from $15.4 million in FY19 to nearly $25.0 million planned in FY23. With the creation of positive life-enhancing youth programs like TEMPO (Tallahassee Engaged in Meaningful Productivity for Opportunity) and equipping our fire stations with life-saving technologies such as Advanced Life Support systems, we remain steadfast in our commitment to rising to new and existing public safety needs. Technology enhancements that support the collaboration and sharing of information among law enforcement agencies and citizen engagement/outreach programs will continue to help us promote safe neighborhoods.

While we continue to succeed with affordable municipal services and economic development, the City is advancing new approaches to respond to the challenges of mental health needs and gun violence. At its March 9, 2022 budget workshop, the City Commission directed staff to include $1 million per year for five years to address issues of gun violence in the community beginning in the FY23 budget.

In response to the Mayor and City Commission's call for additional mental health services, the City proved the success of the Tallahassee Emergency Assessment Mobile Unit (TEAM) as a pilot program and is now adding a second unit for 18 hours a day response. The TEAMs will consist of a licensed mental health professional, a Crisis Intervention Team-trained TPD officer, and other City staff as required. In the pilot year, the unit actively responded to over 2,000 annual non-violent calls for service with individuals experiencing a mental health crisis.

Recently, the City pledged $140,000 of start-up funding into Leon County Sheriff’s Council on the Status of Men and Boys. In addition, the budget recommends an additional $48,750 for the Commission on the Status of Women and Girls.

Survive and Thrive Advocacy Center (STAC) training for businesses to identify human trafficking is funded at $30,000 to match the Leon County Commissioners’ pledge to support the final startup costs needed for this program. Funding for COCA ($492,036) and St. Francis Wildlife Refuge ($30,000) are also included in the budget.

The City will continue to monitor these costs and benchmark them against comparable cities, working to keep them affordable for residents and businesses while maintaining a high quality of services. These principles guide budgetary planning. The City will continue prioritizing investment in targeted areas highlighted by the strategic plan and the City Commission.

Recognition as a National Leader in Public Service Delivery

Our organization is recognized nationally for best practices in financial and performance management with continued awarding of the Certificate of Achievement for Excellence in Financial Reporting of the Combined Annual Financial Reports, and the Distinguished Budget Presentation Award from the Government Finance Officers Association (GFOA), and recognition with a Certificate of Distinction in Performance Management by the International City/County Managers Association.

The national credit rating agencies have also reaffirmed our financial standing with AA bond ratings for our utilities and general government bonds, and with continued receipt of unmodified opinions on the City’s financial statements from our external auditors, the highest opinion that auditors can express on an organization’s financial statements.

Our organization was recognized as a Gold level LEED-certified City by the U.S. Green Building Council, an international rating system for communities to benchmark their sustainability and resilience performance relative to peers across the globe. The City excelled in areas such as enhancing and modernizing the City’s public infrastructure, facilitating the construction of affordable housing, leading in environmental stewardship, providing efficient and equitable public transit, and leading in utility service.

The City received the American Public Power Association’s top award for System Achievement for the second time joining a select few American Public Utilities. We have committed to numerous sustainability goals and efforts, including moving the community to 100% net clean, renewable energy by 2050, the development of a Clean Energy Integrated Resource Plan, electrification of City buses, and installation of publicly available fast-charging stations for electric vehicles.

Finally, the 2021 Water Quality Report shows that the quality of the City’s drinking water surpasses all stringent regulations established by the Florida Department of Environmental Protection (DEP), the U.S. Environmental Protection Agency (EPA), and the Florida Department of Health (DOH).

Conclusion

This FY23 Budget reflects the strategic priorities and leadership of the City Commission, the public input received during ongoing budget workshops and community engagement events, and provides clear direction for staff to address existing and future challenges as we approach our bicentennial in 2024. This input guides additional investment in public safety, human services, infrastructure, neighborhoods, affordable housing, mental health, and gun violence. The City of Tallahassee is a foundation of our community and remains committed to our mission, vision and values, and focused on achieving the targets outlined in our five-year Strategic Plan. With its dedicated staff, community partners, Commission leadership and clear vision, the FY23 budget is presented for your consideration.

Sincerely,

Reese Goad

City Manager

FY2023 Budget Overview 1.0

Introduction and Overview

1.1 Mission

Through workshops, surveys, and commission retreats the City of Tallahassee has developed the following vision, mission, critical success factors. These are the basis for the performance measurement process that each department has implemented.

Mission:

To be the national leader in the delivery of public service.

Vision:

A creative capital city that supports a strong community with vibrant neighborhoods; an innovative economic and educational hub serving a diverse and passionate people, protecting our natural resources and preserving our unique character.

Values:

- Honor public trust through ethical behavior.

- Provide exceptional citizen service.

- Lead with integrity at every level.

- Collaborate to reach common goals.

- Invest in employee excellence.

- Promote equity and celebrate diversity.

1.2 Strategic Plan

In preparation for its bicentennial anniversary in 2024, the City developed a comprehensive 5-year strategic plan. The plan was developed with extensive citizen engagement, both in-person and online, direction from the City Commission, and the integration of more than 40 departmental and master plans. While the budget directs resources for accomplishing one year’s worth of goals and activities, this plan represents the City’s direction through 2024.

To read the complete 2020-2024 Strategic Plan and view the City's progress on the goals and objectives visit Talgov.com/PerformanceDashboard. You can also visit Talgov.com/YearInReview to read about the City's accomplishments during the last fiscal year.

To achieve the City's vision, the City Commission identified seven priority areas to guide service efforts. Each priority area, with its corresponding goals, objectives, and targets, is outlined below.

View Full Strategic Plan Dashboard Economic Development Impact on Poverty Organizational Effectiveness Public Infrastructure - City Utilities Public Infrastructure - Mobility Public Safety Public Trust Quality of Life

1.3 Budget Overview

Short Term Factors

The City's FY23 Budget totals more than $1 billion, which includes $826.8 million for operating expenses and $205.4 million for capital investment. It was developed through a year-round, multi-stage process involving public participation, City Commission input, and a focus on the priorities outlined in the City's Strategic Plan.

For the FY23 Budget, significant factors in the short term that impact services and citizens include:

- Ensuring we are the employer of choice in an increasingly competitive labor market with a 5% across-the-board increase, with a $2,500 minimum for employees earning up to $50,000.

- Remaining an attractive community for families and businesses by maintaining a 4.1 millage rate for the last seven years.

- Funding programs to combat Gun Violence in the City with $1 million in new funding per year.

- Delivering $53 million of cost avoidance to utility customers through effective fuel price management (Oct 2021- Jun 2022).

- Balancing the budget using federal, state, and local resources and coordinating with partners to maximize efficiency and effectiveness in the delivery of services.

The FY23 Budget reflects the City's commitment to respond to these immediate needs in the short term.

Significant economic factors impacting the FY23 budget include:

- A historic increase in inflation, rising from an average of 3.3% in FY21 to 8.5% in July 2022.

- Increasing costs for labor as the job market pressures the City to increase pay to recruit and retain employees.

- Rising costs for fuel, contracts, supplies, and equipment due to inflation and the slow post-pandemic recovery of the supply of goods and the supply chain.

The City's continues to lead the industry in the delivery of high-quality services at an affordable cost to the community as addressed in the Strategic Plan.

Ensuring we are an employer of choice.

In addition to funding pay and benefits to retain and recruit talent, the Strategic Plan includes objectives that support our workforce.

Maintaining a 4.1 millage rate for the seventh year in a row.

After a reduction in FY17 from 4.2 to 4.1 mills, the City has maintained its millage rate for seven consecutive years. Tallahassee currently has the lowest rate of the 20 largest cities in Florida despite the fact that 45% of its property value is exempt from property taxes, compared to 30% statewide.

Balancing the budget using federal, state, and local resources and coordinating with partners to maximize efficiency and effectiveness in the delivery of services.

Through the combined dedication and effort of all employees, the City has controlled costs while still providing the high-quality services the community expects.

Funding programs to combat Gun Violence in the City with $1 million in new funding per year.

Delivering $53 million of cost avoidance to utility customers through effective fuel price management (Oct 2021- Jun 2022).

The City continues to move forward with programs and initiatives that address critical needs and support strategic goals. Within this framework, priorities to further support Strategic Plan goals were funded in the FY23 Budget:

- While we continue to succeed with affordable municipal services and economic development, the City is advancing new approaches to respond to the challenges of mental health needs and gun violence. At its March 9, 2022, budget workshop, the City Commission directed staff to include $1 million per year for five years to address issues of gun violence in the community beginning in the FY23 budget.

- Investment in public safety, neighborhoods, CHSP, and affordable housing increased from $15.4 million in FY19 to nearly $25.0 million planned in FY23.

- In response to the Mayor and City Commission's call for additional mental health services, the City proved the success of the Tallahassee Emergency Assessment Mobile Unit (TEAM) as a pilot program and is now adding a second unit for 18 hours a day response. The TEAMs will consist of a licensed mental health professional, a Crisis Intervention Team-trained TPD officer, and other City staff as required. In the pilot year, the unit actively responded to over 2,000 annual non-violent calls for service with individuals experiencing a mental health crisis.

- Technology enhancements that support the collaboration and sharing of information among law enforcement agencies.

- Ongoing investment in positive life-enhancing youth programs like TEMPO (Tallahassee Engaged in Meaningful Productivity for Opportunity).

- Equipping our fire stations with life-saving technologies such as Advanced Life Support systems.

- Citizen engagement/outreach programs to help us promote safe neighborhoods.

- A pledge of $140,000 of startup funding into Leon County Sheriff's Council on the Status of Men and Boys. In addition, the proposed budget recommends an additional $48,000 for the Commission on the Status of Women and Girls.

- Survive and Thrive Advocacy Center (STAC) training for businesses to identify human trafficking is funded at $30,000 to match the Leon County Commissioners' pledge to support the final startup costs needed for this program.

The City will continue to monitor these costs and benchmark them against comparable cities, working to keep them affordable for residents and businesses while maintaining a high quality of services. These principles guide budgetary planning. The City will continue prioritizing investment in targeted areas highlighted by the strategic plan and the City Commission.

1.4 Millage Rate

The millage rate is the amount per $1,000 used to calculate ad valorem taxes (property taxes). The rate is multiplied by the total taxable value to determine the property taxes due.

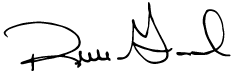

The City of Tallahassee has maintained a millage rate of 4.1 for seven years, the lowest among the 20 largest cities in Florida. It is also the lowest of the 12 cities in the Municipal Cost Comparison, an annual study of costs of living and doing business in municipalities across Florida. The chosen cities share similarities to Tallahassee in population, range of services provided, and rate of taxable property. Below is Tallahassee compared with four cities in the comparison, including Gainesville and Lakeland.

A low millage rate keeps the cost of homeownership affordable while still providing high-quality services.

1.5 Municipal Cost Comparison

When measuring costs to citizens, the City compares itself to a group of eleven cities that share similar demographics, services provided, and square miles served. The Municipal Cost Comparison below contrasts what citizens, both residential and commercial, pay for municipal services.

City utilities undergo regular fee studies to ensure that costs for services are recovered and paid for by those that benefit. The municipal cost comparison, however, demonstrates the competitiveness of rates compared to peer cities across the state. The City ranks as one of the most affordable to citizens year after year.

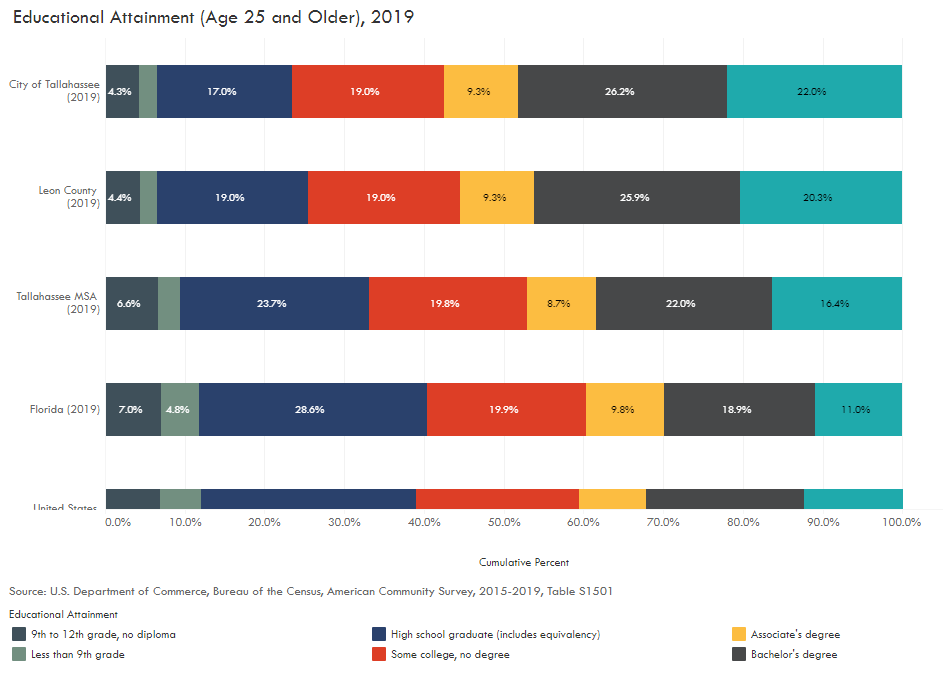

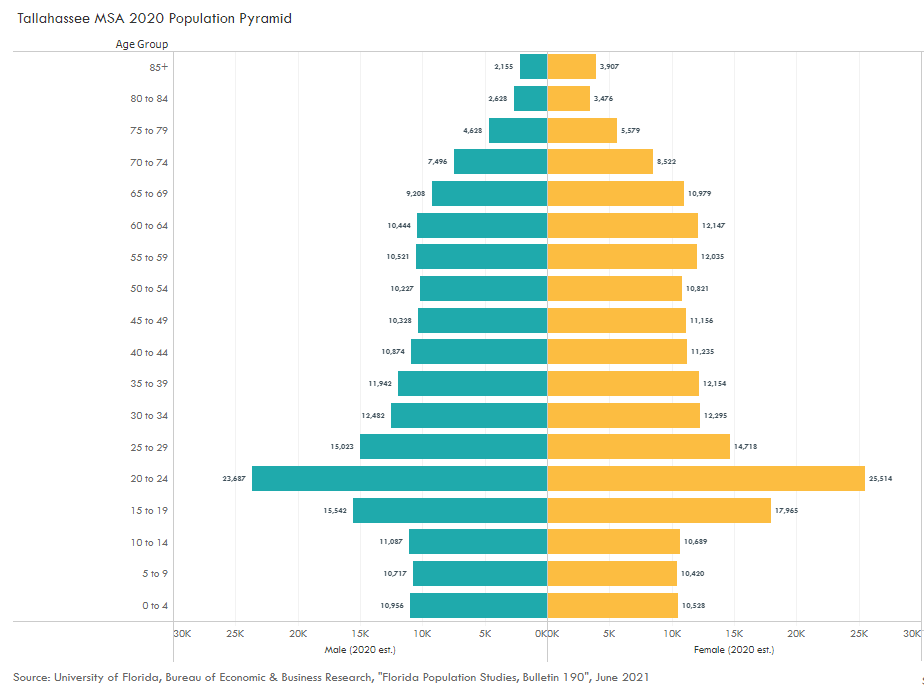

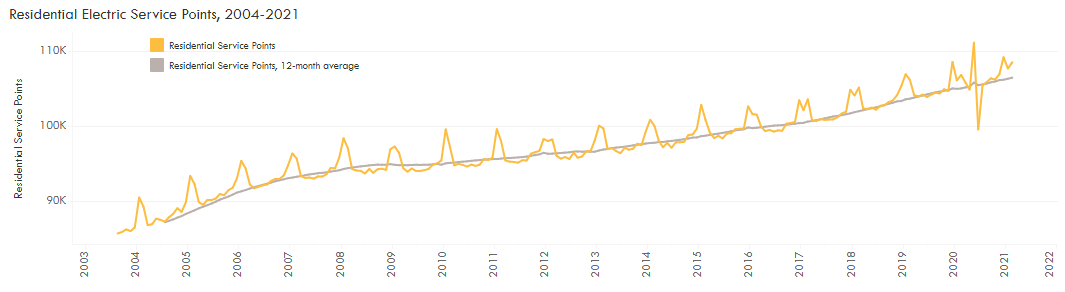

1.6 Population & Other Community Statistics

Tallahassee experiences consistent population growth. The City plans for a continued increase of its services. When making infrastructure decisions, the organization considers not just today’s demands but also tomorrow’s needs.

To view other statistics and trends that formulate the budget and plans for the City, please click here to read the Supplemental Demographic and Economic Information section.

FY2023 BUDGET OVERVIEW 2.0

STRUCTURE, POLICY AND PROCESS

2.2 Fund Descriptions & Structures

A fund is an accounting entity that documents activities. Fund accounting prioritizes accountability over profitability. Separate funds ensure revenues are appropriately related to expenditures.

Government funds support core city services where those paying indirectly benefit from the services. Enterprise funds are self-supported by user fees and charges. These operate similarly to private businesses.

Below are summaries of appropriated funds.

General Fund

This fund supports many core city services, including police, parks and recreation, road maintenance, housing initiatives, economic development, land use, environmental regulation, and animal services. The general government also provides an operating subsidy to Star Metro, the City's transit system.

Fund Type

Government

Surplus

City policy determines the use of any operating fund surplus at year-end and a target level for the deficiencies reserve. Any surplus at year-end is first added to the deficiencies reserve until the amount reaches the target. After fully funding the deficiencies fund, any remaining balance supports the subsequent year’s operating budget, up to a maximum of 5% of general government operating expenditures, and to buy down debt-financed capital improvement projects.

General Fund Transfer

$3.8 million in new funding is budgeted to support projects in FY23.

Operating Reserve

The FY23 revenue budget does not include transfers from General Fund Operating Reserves.

Other

Deficiencies Reserve: If the subsequent fiscal year ends with an operating deficit due to unforeseen circumstances, up to 5% of FY23 year-end surpluses will be available from the Deficiencies reserve as needed.

Fleet Reserve: The FY23 contribution is $2 million

RR&I: Undesignated balance set at a maximum of 3% of general government capital projects.

The Growth Management Department is responsible for enforcing the City’s building codes through the review of building plans, permitting, and the inspection process. Specific actions include ensuring that planned construction complies with applicable codes, authorizing utility connections and issuing certificates of occupancy, providing centralized intake and coordination of all permit applications, administering contractor licensing regulations, and enforcing the rooming house ordinance.

Fund Type

Enterprise

Surplus

To the extent available and appropriable, all year-end surpluses will be retained within the fund and made available for operating expenses and capital projects.

Operating Reserve

The FY23 revenue budget does not include transfers from operating reserves.

Other

Not applicable.

Established in 1902, the Tallahassee Fire Department (TFD) is a municipal fire department that provides fire suppression and emergency medical services in the City and the unincorporated areas of Leon County, Florida. The department protects lives, property, and the environment from hazardous conditions threatening our community. This mission is accomplished by providing prevention and protective services specific to the incident need.

Fund Type

Enterprise

Surplus

Retained for fire operating and capital costs.

General Fund Transfer

No transfer.

Operating Reserve

No reserve.

Other

Not applicable.

The Electric Utility serves over 128,000 customers in a 221-square-mile service territory. It is the fourth-largest municipal electric utility in Florida and the 27th-largest of over 2,000 municipal systems in the United States. The utility comprises six significant divisions: Finance and Administration, Power Delivery, Energy Supply, System Operations, System Compliance, and System Integrated Planning. The Electric Utility develops a 10-year sales forecast annually to use in the annual budget process.

Fund Type

Enterprise

Surplus

Operating fund balance after General Fund transfer minus bond reserves used to fully fund the operating reserve, with the balance designated for electric system capital projects.

General Fund Transfer

The transfer is based on CPI. The transfer for FY23 is $35.1 million.

Operating Reserve

The operating reserve comprises four subcomponents, with the primary purpose of providing working capital. The working capital component is targeted to having a balance of 60 to 90 days of operating expenses. The other three components are fuel risk management, emergency reserve, and rate stabilization.

Other

RR&I: Transfer budgeted at a level equivalent to depreciation expense as provided in the Comprehensive Annual Financial Report (CAFR).

The City of Tallahassee's Natural Gas Utility has provided clean, safe, economical, and reliable natural gas to residents and businesses in a growing service area for over 60 years. The utility safely provides natural gas energy through hundreds of miles of underground gas mains, which serve over 34,000 customers in the Leon, Gadsden, and Wakulla areas. The highly trained staff works to ensure the distribution system's integrity and dependability and assist customers with energy conservation and cost savings through natural gas use.

Fund Type

Enterprise

Surplus

Designated to fund the operating reserve fully and, after that, to fund gas system capital projects

General Fund Transfer

The transfer is based on CPI. The transfer for FY23 is $3.4 million.

Operating Reserve

Funded at 25% of the previous year’s General Fund transfer and used to meet General Fund transfer, if required.

Other

RR&I: Transfer budgeted at a level equivalent to depreciation expense as provided in the applicable rate study.

The City’s water system currently services 88,000 connections with approximately 9 billion gallons of water per year. This around-the-clock operation employs 27 water wells and treatment facilities, eight elevated storage tanks, 7,200 fire hydrants, and over 1,200 miles of water distribution piping.

Fund Type

Enterprise

Surplus

Designated to fund the operating reserve fully and, after that, to fund water system capital projects.

General Fund Transfer

The transfer is based on CPI. The transfer for FY23 is $4.1 million.

Operating Reserve

Funded at 25% of the previous year’s General Fund transfer and used to meet General Fund transfer, if required.

Other

RR&I: Transfer budgeted at a level equivalent to depreciation expense as provided in the Comprehensive Annual Financial Report (CAFR).

The City of Tallahassee's Sewer Utility is responsible for collecting, treating, and disposing of wastewater and treating commercially pumped sewage. Wastewater is treated in the City’s Advanced Wastewater Treatment plant to a standard that exceeds regulatory requirements as part of the City’s commitment to protecting the environment. The system services over 76,000 service points. The City's wastewater operation treats an average of 17.5 million gallons per day, transporting raw sewage from homes and businesses in Tallahassee to the ThomasP. Smith (TPS) Advanced Water Reclamation Facility. This facility provides wastewater treatment that reduces total nitrogen in treated wastewater to well below regulatory standards in order to protect Wakulla Springs.

Fund Type

Enterprise

Surplus

Designated to fund the operating reserve fully and, after that, to fund sewer system capital projects.

General Fund Transfer

The transfer is based on CPI. The transfer for FY23 is $5.65 million.

Operating Reserve

Funded at 25% of the prior year’s General Fund. Used to meet General Fund transfer, if required.

Other

RR&I: Transfer budgeted at a level equivalent to depreciation expense as provided in the Comprehensive Annual Financial Report (CAFR).

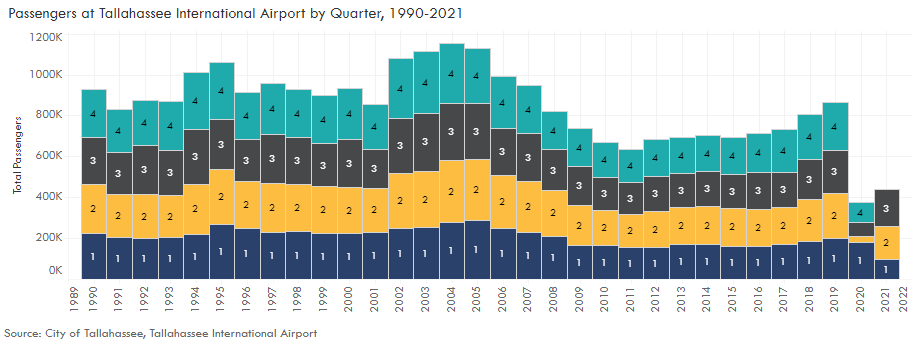

The Aviation Fund supports operations at the Tallahassee International Airport (TLH), including the Aviation Department’s six divisions and the Airport Police and Airport Parking divisions. The Fund also contributes to the Fire Fund for the Tallahassee Fire Department’s operations at the Airport.

The Airport hosts three airlines (American Airlines, Delta Air Lines, and Silver Airways) that deliver non-stop service to seven destinations and provide amenities to customers, including valet parking, long- and short-term parking, a cell phone parking lot, rental car options, a public waiting area, business center, dining options, and more. As part of the City’s five-year strategic plan, Tallahassee International Airport will be constructing an International Passenger Processing Facility, with a five-year goal of making a $1 billion annual economic impact.

Fund Type

Enterprise

Surplus

Retained within the fund and allocated according to the airline use agreement.

General Fund Transfer

No transfer to General Fund. Full recovery of cost.

Operating Reserve

A minimum of 1/12th of the Airport's operating and maintenance budget is designated for unanticipated non-recurring expenditures.

Other

RR&I: Not applicable.

StarMetro, the public transit service for the City of Tallahassee, operates 14 weekday cross-town routes, including university service for Florida State University (FSU) and student ridership programs for Florida Agricultural & Mechanical University (FAMU), Tallahassee Community College (TCC) and K-12 students in Leon County.

The Fixed Route and Para-transit department provides accessible, equitable, and efficient transit services to citizens of Tallahassee, visitors, and commuters. Transit services are provided 363 days a year and assist in emergency situations as needed.

Fund Type

Enterprise

Surplus

Retained within the fund for operating expenses and capital projects.

General Fund Transfer

Transfers in from the General Fund support StarMetro operational deficits, when necessary.

Operating Reserve

No Reserve.

Other

RR&I: Not applicable.

The Solid Waste Fund provides garbage, recyclable materials, bulk, and yard waste collection for all residential customers citywide, and garbage and recyclable materials collections for commercial customers. Currently, the City serves 51,572 residential, 25,308 commercial, and 1,835 commercial recycling service points. Services include:

- residential bi-weekly curbside collection of bulky items, yard waste, electronics, and white goods,

- dumpster services for commercial customers collected by front-end loading trucks at night, up to six times per week,

- commercial container service with roll-off or hook trucks up to six times per week,

- commercial recycling up to five days per week, as well as other enhanced services, and,

- dead animal removal.

Fund Type

Enterprise

Surplus

Retained for rate stabilization reserve.

General Fund Transfer

Each year the transfer is increased by CPI. The transfer for FY23 is $2.2 million.

Operating Reserve

No Reserve.

Other

RR&I: Not applicable.

The Stormwater Fund manages and develops infrastructure for drainage, flood prevention, and retention of stormwater run-off to prevent pollutants from entering the aquifer. Work includes capital project oversight, maintenance of drainage infrastructure such as retention ponds and drainage outfalls, monitoring of lakes and groundwater, and raising public awareness of the environmental impacts of pollution, such as the Think About Personal Pollution (TAPP) program. The Stormwater Utility serves 77,000 residential customers and 6,000 non- residential customers through operational activities and the design and construction of drainage facilities infrastructure. This includes the maintenance of drainage facilities and ponds throughout the City.

Fund Type

Enterprise

Surplus

Retained for stormwater system capital projects.

General Fund Transfer

The transfer to the General Fund represents administrative cost sharing only.

Operating Reserve

No Reserve.

Other

RR&I: Maximum of 5% of capital projects funding sources, with a minimum level of 3%.

The Golf Fund supports Hilaman Golf Course, which offers a community-wide golf experience through daily rounds, driving range use, charity events, tournaments, and more. Hilaman also has a Pro Shop, restaurant, and outdoor deck area that provide a well-rounded experience. The course is open daily from 7:30 a.m. until dark, and course operations are led by a General Manager and two full-time staff members: a foreman and a course maintenance supervisor. In addition, Hilaman has over two dozen part-time employees who help with various day-to-day operations.

Fund Type

Enterprise

Surplus

Retained for Golf operating and capital costs.

General Fund Transfer

No transfer.

Operating Reserve

No reserve.

Other

Not applicable.

View full schedule of major and nonmajor funds.

View matrix of the relationship between departments and funds.

2.3 Basis of Budgeting

Budgets for general operation funds (General, StarMetro, and Golf Course Funds) are prepared on a modified accrual basis. The obligations for these funds (i.e., outstanding purchase orders) are considered expenditures, but revenues are recognized only when they are measurable and available. At the end of the fiscal year, open encumbrances are reported as reservations of fund balance. The operating budget does not include expenses for depreciation.

The budgets for the City’s utilities (Electric and Underground) and other enterprise funds (Aviation, Building Inspection, Solid Waste, Fire, and Cemeteries) are budgeted on a full accrual basis. Expenditures are recognized when a commitment is made (e.g., through a purchase order). Revenues are also recognized when they are obligated to the City, such as when utilities distribute bills.

The basis of budgeting is the same as the basis of accounting used in audited financial statements. Budget and accounting procedures are subject to modifications to comply with generally accepted accounting principles (GAAP) and the Governmental Accounting Standards Board (GASB) standards.

2.4 Internal Policies

There are several statutory requirements, internal policies, and other provisions that direct the development of the budget and its implementation throughout the year.

Florida Statutes, Chapter 166 – This statute authorizes municipalities to levy taxes, issue licenses, and set user fees to raise money necessary to conduct municipal government activities. This chapter also requires that local governments adopt a balanced budget. The tentative balanced budget must be posted on the municipality’s official website at least 2 days before the budget hearing, held pursuant to s. 200.065 or other law, to consider such budget. The final adopted balanced budget must be posted on the municipality’s official website within 30 days after adoption.

Comprehensive Plan – The Tallahassee-Leon County 2010 Comprehensive Plan was originally adopted by ordinance in FY 1990 and is updated with biannual amendment cycles. The Plan includes capital improvements, transportation, historic preservation, utilities, recreation, and other elements which provide a framework for allocating budget resources. The Capital Projects Summary consists of a listing of capital projects that address Comprehensive Plan initiatives by eliminating deficit levels of services or by maintaining existing levels of service.

Financing Policy, No. 224 Commission Policies – The financing policy establishes guidelines for the distribution of year-end surpluses, transfers from the utilities to the General Fund, types and amounts of operating reserves, and funding for capital projects from undesignated fund balance year-end revenues. The policy also provides for full recovery of cost for enterprise funds, limits non-utility fee increases to a maximum of 20% per year unless otherwise approved by the City Commission, and allows discount fees for recreational programs for youth, seniors, and disabled citizens. The “Finance Policy Summary” chart shows the policy's requirements as applied to each fund.

Risk Management Policy/Self-Insurance, No. 214 Commission Policies – This policy creates an internal service fund for payment of anticipated claims and judgments for coverage areas defined in the policy. In addition, a special Insurance Reserve Fund is established and funded to meet unanticipated losses from catastrophic events or claims in excess of the Risk Management Fund. This reserve is set at 150% of the average claims for the past five years or $3,000,000, whichever is greater.

Capital Project Management, No. 218 Commission Policies – This policy provides for the preparation of an annual capital budget and a five-year capital improvement plan. The policy also defines the roles and responsibilities of city departments and management regarding contracts, supplemental appropriations, expenditures, and project administration. The use of capital project overhead charges as an operating budget funding source also is established by this policy.

Local Option Sales Tax Management, No. 232 Commission Policies – This policy establishes the authority to provide advance funding for local Florida Department of Transportation (FDOT) projects for any project or project phase included in the FDOT five-year work plan. It allows for advance funding without an agreement for repayment after conducting a public hearing. The policy also authorizes using short-term debt to cover cash flow shortages that may result from this practice.

Debt Management Policy, No. 238 Commission Policies – The debt management policy, along with an analysis of the city’s compliance with the policy, is included in the capital budget summary and the capital improvement plan. Section 104 of the City Charter also specifies that general obligation debt will not exceed 20% of the assessed taxable valuation. Florida Statutes require that general obligation bonds be approved by referendum. The city currently does not have any general obligation bonds.

Vehicle Replacement Reserves – Funding for vehicle replacement is included annually in the capital budget. Vehicle replacement charges for a proportionate share of these costs are allocated based on equipment usage.

Bond Covenants – Before 1998, provisions of Bond Resolutions required that a minimum of 5% of prior year gross revenues be budgeted annually for Renewals, Replacements, and Improvements (RR&I) for system improvements in the utility systems. Covenants for the Energy System (electric and gas) bonds issued after 1998 do not specify an explicit amount or methodology but require a transfer to an RR&I fund.

Union Agreements – Currently, unions represent 634 authorized positions. A total of 356 positions are subject to terms and conditions of the collective bargaining agreement with the Big Bend Chapter of the Florida Police Benevolent Association, Inc. (PBA), and 278 positions are subject to terms and conditions of the collective bargaining agreement with the International Association of Firefighters (IAFF). Union agreements are generally negotiated every three years. FY23 is the last year of the current contract for all bargaining units.

Utility Rate Studies – Rate studies are prepared for each utility enterprise operation (electric and underground utilities) every three to five years on a rotating basis. Revenue projections are prepared using historical weather patterns and other growth factors.

Assessment and Fee Reviews – Fees and assessments are periodically reviewed to ensure recovery of costs to provide certain services. A cost of services study for the animal shelter was conducted in 2006, which recommended a plan to recover at least 50% of the operating costs through animal licensing fees, but this has not been implemented. The City Commission also increased building inspection fees in August 2009 to recover all eligible building inspection costs. Rates for electricity, underground utilities, and solid waste are set by ordinances that provide for annual increases based on the CPI.

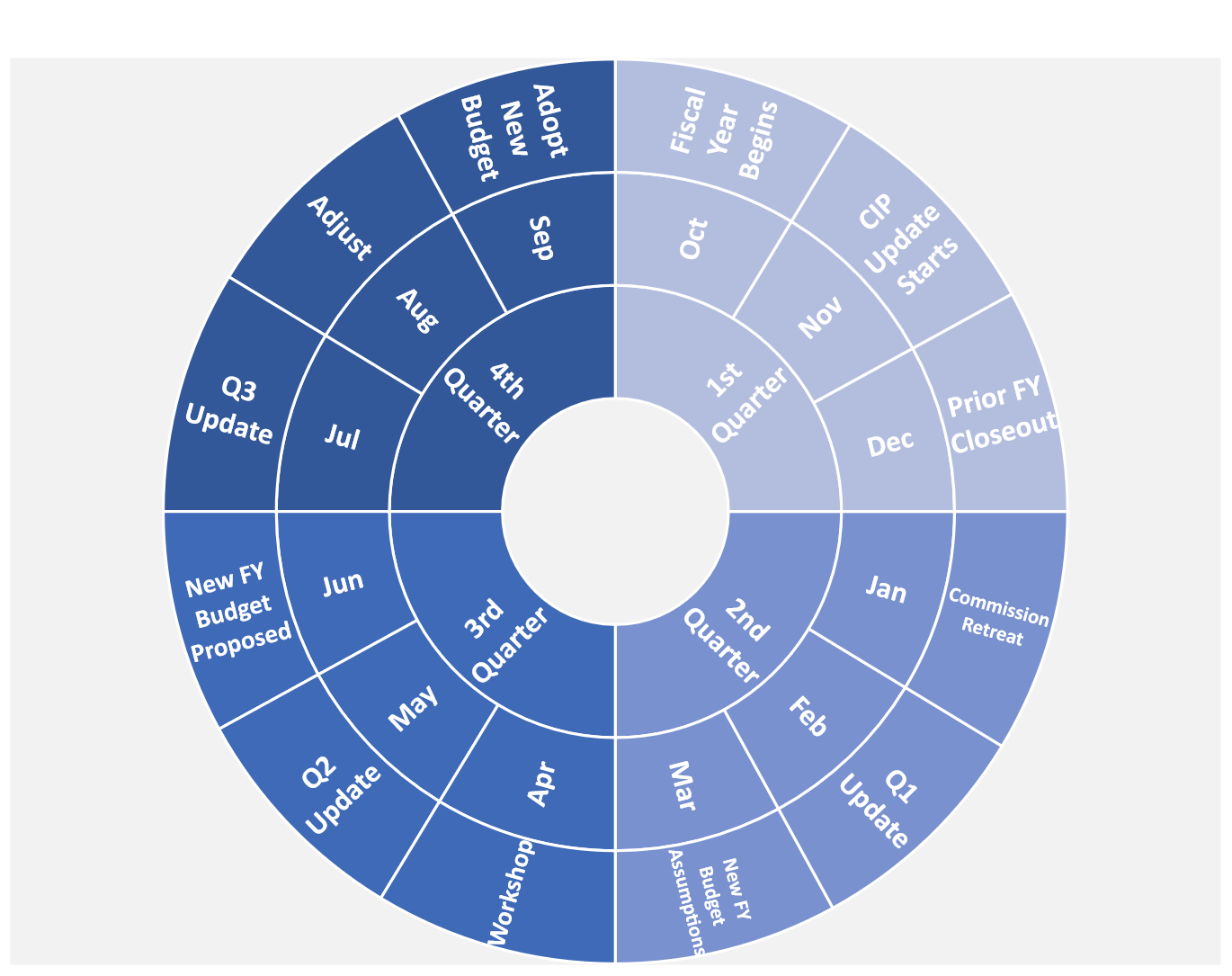

2.6 Budget Process

The budget process involves collaboration and coordination among city departments, Resource Management, executive leadership, the City Commission, and the citizens of Tallahassee. It results in annual operating budgets, capital budgets, and a five-year financial and capital improvement plan for the General Fund and enterprise funds. While the fiscal year begins on October 1st, the budget is a continuous cycle.

The City holds several budget workshops throughout the year. These serve the dual purpose of updating for the current fiscal year and the next budget cycle. Workshops are less formal city commission meetings that do not include a litany of items for the commissioners to address. Instead, the workshop allows for a focused discussion on the topic.

At the first quarter workshop, Resource Management reports on the early status of its funds to the Commission for the current budget cycle. It also presents some initial assumptions to work toward for the next one. This includes proposing an initial millage rate and employee raises, benefits, and other items.

At the second quarter workshop, assumptions are reaffirmed, and priorities are addressed. Issues with the current year’s funding can be addressed while taking a stronger look at the upcoming year.

Resource Management presents a proposed budget for the following fiscal year at the third quarter workshop. These include most of the capital projects, priorities, and changes. Any significant issues for the current budget year are also addressed at this workshop.

The City maintains a “hold the line” philosophy when budgeting for departments’ operating costs. Budgets for things such as office supplies or contracts are not increased every year. Without automatic increases in budgets, staff innovate for cost savings annually. Departments evaluate procedures to be more efficient. Maintaining cost levels helps the City to keep its millage rate the same.

Hold the Line counters a classic budgeting issue known as “use it or lose it.” In older budgeting techniques, departments are incentivized to spend their budget entirely and use their resource depletion to justify maintaining their budget levels. Sometimes the spending would persuade for even higher budgets the following year. With Hold the Line, Resource Management assures departments that their budget levels are safe. This approach leads to less spending overall as departments do not spend money merely to defend their allocations. get year are also addressed at this workshop.

At the 1st quarter budget workshop, staff present initial assumptions to the City Commission for the next budget year. These include two major items: millage rate and staff pay raises.

For the City to be a leader in public service, it must recruit, train, and retain the best people. The City has a history of regular increases for staff ranging from two to three percent. This accommodates the cost of living increases, but the commitment can attract the best employees to the organization.

A diversity of revenue sources blesses the City both through a purposeful strategy and as a matter of history. This allows the City to keep its millage rate very low compared to other governments, and it has avoided increasing millage for many years.

Departments are responsible for developing their respective budget requests with support from Resource Management. City Commission budget workshops are held throughout the year to discuss policy issues and the long-term ramifications of budgetary decisions. The City Commission adopts a tentative millage rate for assessing ad valorem taxes in early July, as state statutes require. The final budget and the millage rate are adopted by resolution during the month of September, following two statutorily required public hearings.

The City’s budget is appropriated at the fund level. Revenues are budgeted at the fund level only, while Department expense budgets are contained within one or more cost centers. There are currently nearly two hundred cost centers across all departments.

Budgetary control is maintained at the department level, with Resource Management providing support. In accordance with the city’s budget transfer policy, departments can amend budgets in various ways depending on the type of transfer being considered.

Any budgetary amendment within the department’s appropriated budget and within the same fund can be authorized by the City Manager. Transfers between departments that cross funds or increase appropriations are made at the request of the City Manager and must be approved by the City Commission.

Budgetary amendments between divisions and within the same fund may be initiated at the department head's discretion, except for transfers affecting specific categories such as personnel. Requests for amendments to the line item exceptions are reviewed by Financial Management and approved by the City Manager or respective appointed official for transfers affecting the offices of the City Attorney, Inspector General, or City Treasurer-Clerk.

Since implementing the PeopleSoft financial system, budgetary control has moved from the line-item level to the major budget category. In classic line-item budgeting, departments cannot spend more than a certain amount on very specific categories. This tended to limit flexibility, and governments could not adapt to problems that arose throughout the year. Now, departments may over-expend line items provided balances are available in the respective major budget category. This allows for greater managerial flexibility. Department heads can respond to citizens’ needs without dense bureaucratic processes.

FY2023 BUDGET OVERVIEW 3.0

FINANCIAL SUMMARIES

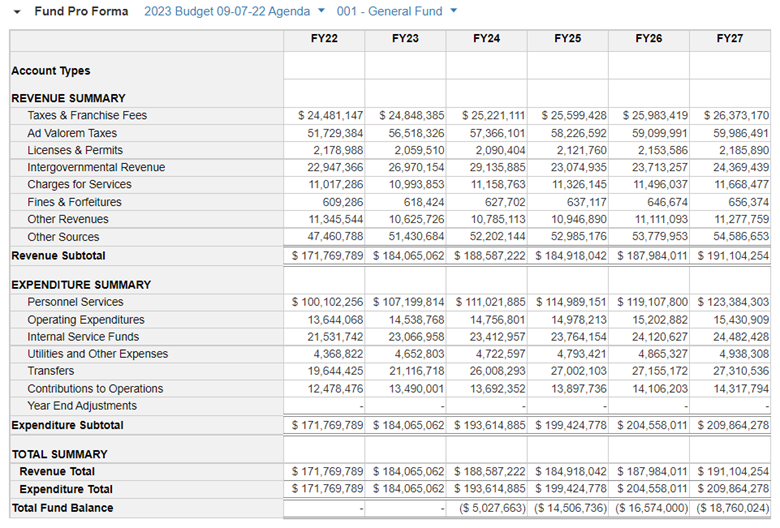

Five-Year Fund Proformas – Revenues and Expenses by Fund

By clicking on the fund titles below, a five-year proforma of revenues and expenditures will display for each. The proforma includes the budget for the prior year, FY22, the adopted budget for FY23, and projections for the remaining years, FY24 – FY27. The five-year forecast is a means of facilitating long-range and financial planning. Below each proforma is a summary of FY23 budget highlights and a link to see an additional view of the fund in OpenGov.

See additional views of FY23 budget in OpenGov

See additional detail of the Five-Year Fund Pro Formas.

Estimated revenues and expenditures for FY23-FY28 reflect revenue projections and current expenditure levels. The latter years of the pro forma indicate how expected trends applied to current estimates will shape future budget planning.

Budget Highlights

FY23

- Based on taxable value, the property tax revenue for FY23 increased by $4.8 million, or 9.3%. For existing property owners with a homestead exemption, assessed valuations are lower than market value, as the Save Our Homes amendment caps increases for the homesteaded property at 3% regardless of any increase in assessed valuation by the Property Appraiser’s office. At $56.5 million, property taxes provide 31% of General Fund Revenues.

- Contributions from utilities increased with CPI by 8.5% for FY23 based on City policy. At $50.5 million, contributions make up 27.4% of General Fund revenues, adding $4 million in revenues.

- In FY23, the budget includes $5.1 million in American Recovery Plan Act revenue claims.

- In FY23, 1.00 new FTE is funded for the Riley House. For the Animal Services Center, one new FTE is funded, and two are converted from Other Personnel Services (OPS) to permanent FTEs.

FY24-27

- Future revenue projections remain conservative as the City keeps the millage rate low to encourage growth and investment. Other options for revenue generation are limited by statute, and existing, significant revenue sources are sensitive to unforeseen economic impacts.

- Personnel costs for future years reflect a 3.6% increase through FY27. However, due to inflation and a tight labor market, the City expects to increase this estimate to remain an employer of choice.

- Operating costs from FY24 to FY27 are escalated by 1.5% overall.

- Transfer estimates vary primarily based on expected changes in existing debt service payments. Debt Service from FY24 through FY27 will increase based on the timing of borrowing for large projects.

- Estimates for FY24-FY27 do not include estimated increases in the number of positions in the fund—departments review service needs and staff levels during the annual budget development process.

The General Fund for FY23 totals $184 million and includes the Tallahassee Police Department, Parks & Recreation, Public Infrastructure (roads and street construction and maintenance), Community Housing and Human Services, and other non-utility services. The fund also contributes to StarMetro and the Consolidated Dispatch Agency, transfers the ad valorem share due to the community redevelopment agencies, and transfers funding for capital projects and debt service.

See additional views of FY23 budget in OpenGov

See additional detail of the Five-Year Fund Pro Formas.

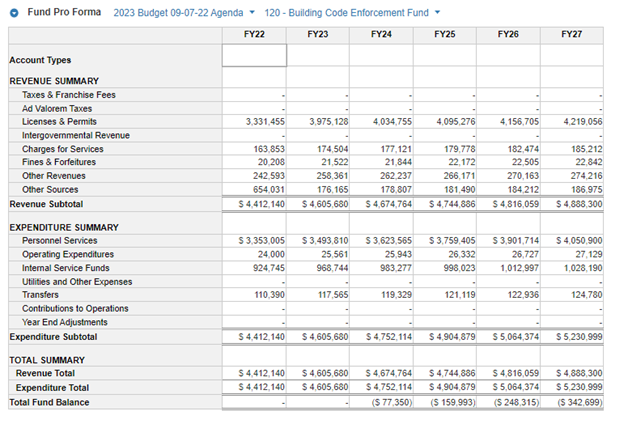

Estimated revenues and expenditures for FY23-FY27 generally reflect revenue projections and current expenditure levels escalated by a CPI factor and indicate how expected trends applied to current estimates will shape future budget planning.

Budget Highlights

FY23

- The fund is self-sustaining, with fees from increased activities in a given year expected to support the fund over several years of service. Fees were increased effective October 1, 2022, to ensure full cost recovery for FY23. At the same time, an annual rate increase tied to CPI effective each year on October 1 was approved for consistency with rate policy across other enterprise funds and to provide incremental revenue increases as costs increase over time.

FY24-27

- Revenues are projected at an escalator of 1.5% in later years, although revenues tend to vary significantly over time, and demand is difficult to predict.

- Personnel costs escalated by less than 4% through FY27, however inflation and a tight labor market may require higher pay increases to remain an employer of choice..

- Operating costs are escalating by 1.5% overall.

The Building Inspection Division operates as a separate enterprise fund established to account for all activities related to enforcing the City’s building inspection regulations. The fund provides for the enforcement and implementation of the Florida Building Code. The Building Inspection Division is recognized locally as delivering a high level of service, responding to inspection requests, and providing timely plan reviews.

See additional views of FY23 budget in OpenGov

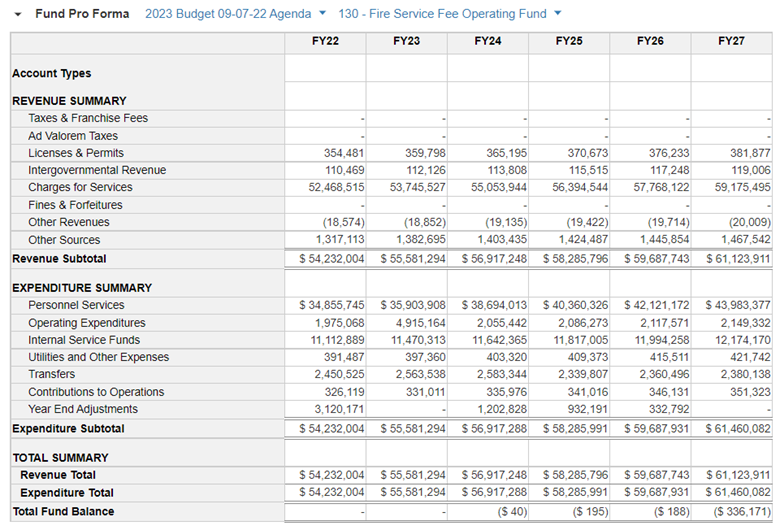

See additional detail of the Five-Year Fund Pro Formas.

Estimated revenues and expenditures for FY23-FY27 generally reflect revenue projections and current expenditure levels escalated by a CPI factor and indicate how expected trends applied to current estimates will shape future budget planning.

Budget Highlights

FY23

- The Tallahassee Fire Department will continue to provide outstanding services to the community at their current staffing level.

- The City and County are currently engaged in a joint fire services fee study and will present recommendations during the FY24 budget development process for any fee adjustments to be made in FY24 or subsequent years.

FY24-27

Personnel costs for the upcoming Fire Station 17 are budgeted beginning in FY24. The current collective bargaining agreement between the City and the International Association of Fire Fighters will expire at the end of FY23. A new agreement will affect personnel costs for future years.

Established in 1902, the Tallahassee Fire Department (TFD) is a municipal fire department that provides fire suppression and emergency medical services in the City and the unincorporated areas of Leon County, Florida. The department is charged with the responsibility of protecting lives, property and the environment from hazardous conditions that threaten our community. This mission is accomplished through the provision of prevention and protective services specific to the incident need. The Tallahassee Fire Department staff of 300 people includes 285 sworn and 15 non-sworn personnel. Department activities are broadly grouped into Training, Emergency Management, Prevention, Operations (Suppression), Logistics, Public Education, Plans Review and Human Resources and Finance support functions. The Tallahassee Fire Department also provides quality first response non-transport Basic Life Support (BLS) and Advanced Life Support (ALS) services in conjunction with Leon County Emergency Medical Services (EMS). Department services are provided through 16 fire stations and an administrative office in the Public Safety Complex.

In FY20, the City Commission voted to delay the planned rate change for the fire assessment program, that would have taken effect in FY21, due to the financial impacts residents were experiencing from COVID-19. Throughout FY21, the Fire Department focused on reducing expenses to account for the missed revenue. A resolution was adopted by the City Commission to implement rate changes in FY22 and went into effect on October 1, 2021.

See additional views of FY23 budget in OpenGov

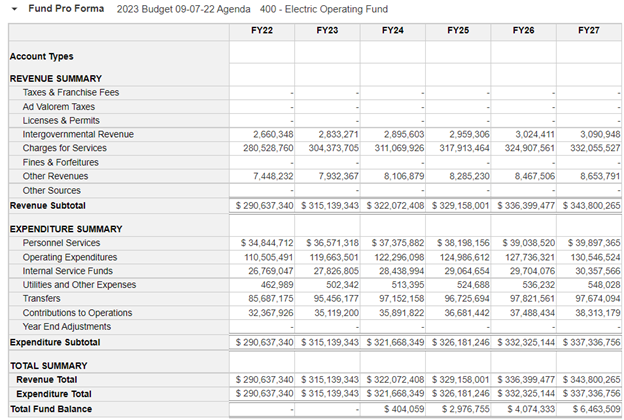

See additional detail of the Five-Year Fund Pro Formas.

Estimated revenues and expenditures for FY23-FY27 generally reflect revenue projections and current expenditure levels escalated by a CPI factor and indicate how expected trends applied to current estimates will shape future budget planning.

Budget Highlights

FY23

- The Electric Utility develops 10-year sales forecast annually to use in the annual budget process.

- An Electric Rate Study is planned for the Spring of FY23.

FY24-27

- The Electric Utility continues to invest in the current electric grid by enhancing funding in tree trimming and systemwide switch inspection and replacement.

- There is also a focus on enhancing transmission reliability and import capability through additional bulk power system interconnections.

- The department continues to look to the future and is working with consultants and key stakeholders to develop and implement the City’s Clean Energy Plan.

- Continued funding of pilot EV charging stations program and installation of new stations at key locations throughout the City.

The Electric Utility serves over 128,000 customers in a 221-square mile service territory. It is the fourth largest municipal electric utility in Florida, and the 24th largest of over 2,000 municipal systems in the United States. The utility is comprised of six major divisions: Finance and Administration, Power Delivery, Energy Supply, System Operations, System Compliance, and System Integrated Planning. The Electric Utility develops a 10-year sales forecast annually to use in the annual budget process. This sales forecast is based on a variety of inputs, such as heating and cooling degree days, economic, and population growth, the weather being the most variable driver. As the year progresses, actual sales are used to guide the operational decisions of the utility.

See additional views of FY23 budget in OpenGov

See additional detail of the Five-Year Fund Pro Formas.

Estimated revenues and expenditures for FY23-FY27 generally reflect revenue projections and current expenditure levels escalated by a CPI factor and indicate how expected trends applied to current estimates will shape future budget planning.

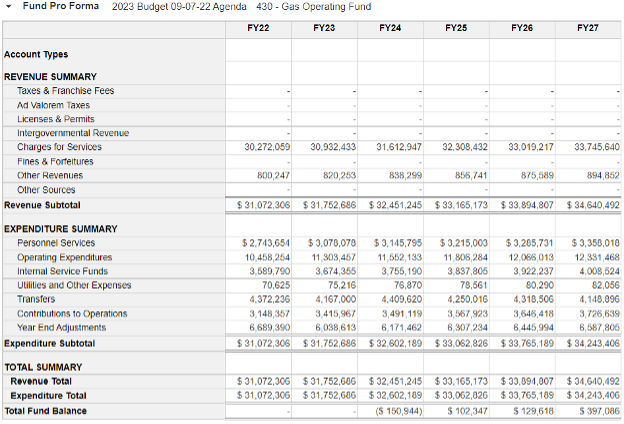

Budget Highlights

FY23

- A rate study was completed in 2022 and provides for the assumptions in the pro forma and future obligations.

FY24-27

- The department continues to look to the future and is working with consultants and key stakeholders to develop and implement the City’s Clean Energy Plan.

- Enhancement of Gas Leak Detection and Repair (LDAR) Program.

- Further implementation of the Utility’s Methane Reduction Program.

The City of Tallahassee's Natural Gas Utility has provided clean, safe, economical and reliable natural gas to residents and businesses in a growing service area since 1956. The utility safely provides natural gas energy through 965 miles of underground gas mains that serve over 34,000 customers in the Leon, Gadsden, and Wakulla County areas. The highly trained staff works to ensure the integrity and dependability of the distribution system, and to assist customers with energy conservation and cost savings through natural gas use.

See additional views of FY23 budget in OpenGov

See additional detail of the Five-Year Fund Pro Formas.

Estimated revenues and expenditures for FY23-FY27 generally reflect revenue projections and current expenditure levels escalated by a CPI factor and indicate how expected trends applied to current estimates will shape future budget planning.

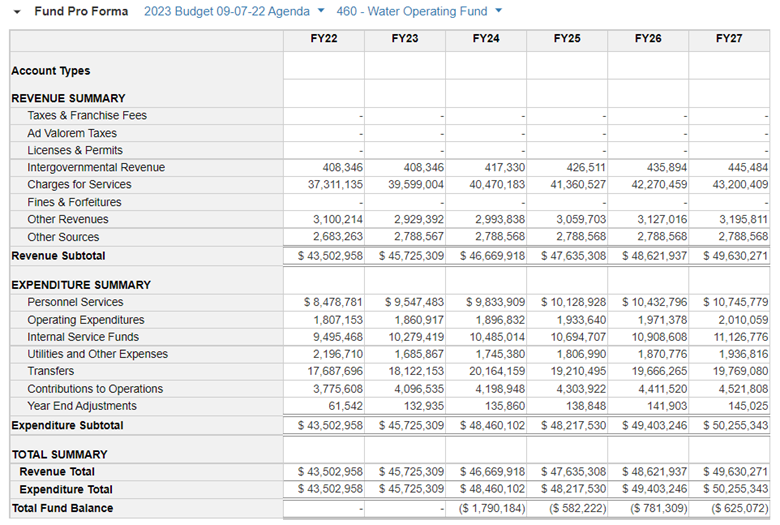

Budget Highlights

FY23

- Following an FY21 rate study, water rates were increased by CPI set at 8.5% on October 1st, 2022. Total customer impact on average residential utility bill (6,000 gallons) equates to $1.91 per month.

- Operating expenditures were redistributed based on a three-year average, resulting in a conservative increase of 3.5%. Additional savings in Utility expense of $510,000 will help offset inflationary pressures and ensures the fund meets its targeted RR&I transfer.

- Capitalized Wage expense is reduced by $660,000 based on historical trends for direct labor charges to projects and aligns with the reductions made in FY2022 to Capitalized Overhead revenue. The reduction results in a net increase in Personnel Services.

- The Renewal, Replacement, and Improvement (RR&I) transfer for the capital improvements of Water infrastructure increased to $6.4 million, up from $6.1 million in FY22.

FY24-27

- Assumptions for rate revenues include modest customer growth of 1% and CPI set at 2.5% through FY2027.

- Operating expenses are estimated at an inflation rate of 2.5% per year and include plans for future debt in FY2024.

Commitment to capital investments includes a future borrowing in FY2024 and a 5% average increase per year in the RR&I transfer through FY2025.

See additional views of FY23 budget in OpenGov

See additional detail of the Five-Year Fund Pro Formas.

Estimated revenues and expenditures for FY23-FY27 generally reflect revenue projections and current expenditure levels escalated by a CPI factor and indicate how expected trends applied to current estimates will shape future budget planning.

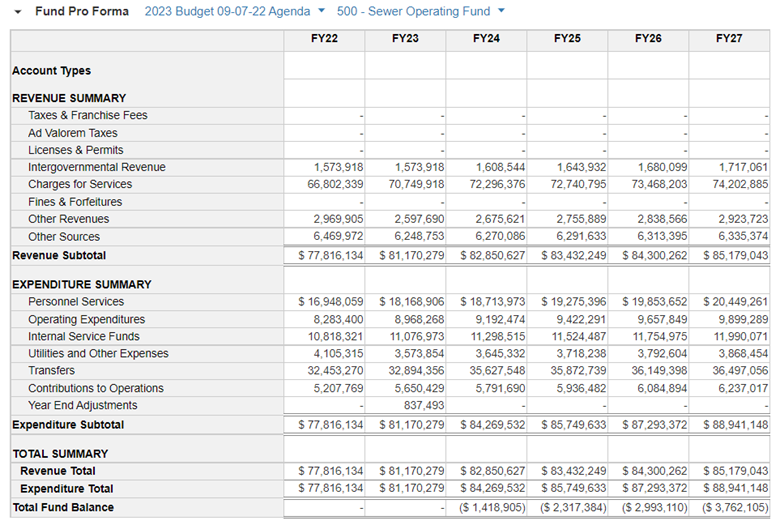

Budget Highlights

FY23

- Following an FY21 rate study, sewer rates were increased by CPI set at 8.5% on October 1st, 2021. Total customer impact on average residential utility bill (5,000 gallons) equates to $4.63 per month.

- Operating expenditures were redistributed based on a three-year average, resulting in a conservative increase of 4.7%. Additional savings in Utility expense of $230,000 will help offset inflationary pressures and ensures the fund meets its targeted RR&I transfer.

- The Renewal, Replacement, and Improvement (RR&I) transfer for the capital improvements of Water infrastructure increased to $11.7 million, up from $11.1 million in FY22.

FY24-27

- Assumptions for rate revenues include modest customer growth of 1% and CPI set at 2.5% through FY2027.

- Operating expenses are estimated at an inflation rate of 2.5% per year and include plans for future debt in FY2024.

Commitment to capital investments includes a future borrowing in FY2024 and a 3.3% average increase per year in the RR&I transfer through FY2025.

See additional views of FY23 budget in OpenGov

See additional detail of the Five-Year Fund Pro Formas.

Estimated revenues and expenditures for FY23-FY27 generally reflect revenue projections and current expenditure levels escalated by a CPI factor and indicate how expected trends applied to current estimates will shape future budget planning.

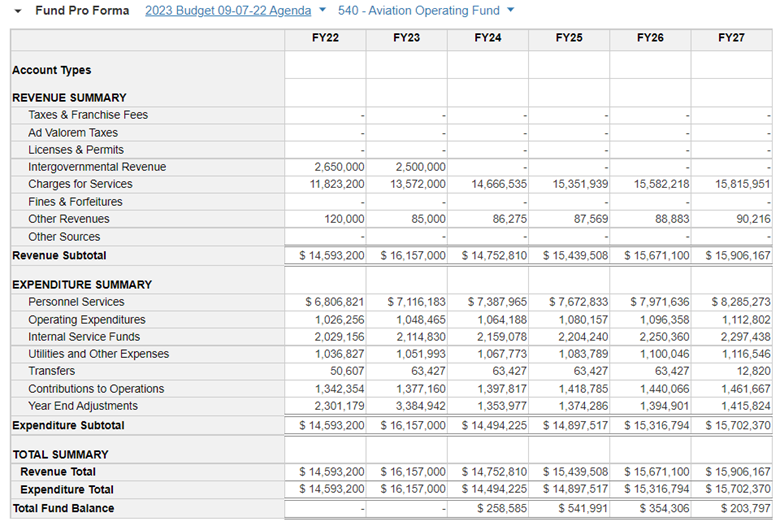

Budget Highlights

FY23

- Total revenues have increased over the past three years, including a $1.5 million increase in revenue this FY. The increase is primarily due to a return to pre-pandemic airport traffic, including increases in Rental Car and Parking Lot Revenues.

- The airport continues to receive considerable grant funding for capital projects.

- Expenses are set to increase by $1.5 million from FY22 to FY23 due to a rise in overall operational needs and RR&I investments.

- FTE employees have stayed constant at 54 since FY19

- Major Capital projects are ongoing at the airport, including the International Processing Facility, Terminal Modernization, Parking Facility improvements, and Taxiway Rehabilitation.

FY24-27

- Planning for future taxiway rehabilitation projects, along with additional facility capital improvements

The Bipartisan Infrastructure Bill estimates the airport to receive roughly $15.4 million over the next five years (FY23 – FY27).

See additional views of FY23 budget in OpenGov

See additional detail of the Five-Year Fund Pro Formas.

Estimated revenues and expenditures for FY23-FY27 generally reflect revenue projections and current expenditure levels escalated by a CPI factor and indicate how expected trends applied to current estimates will shape future budget planning.

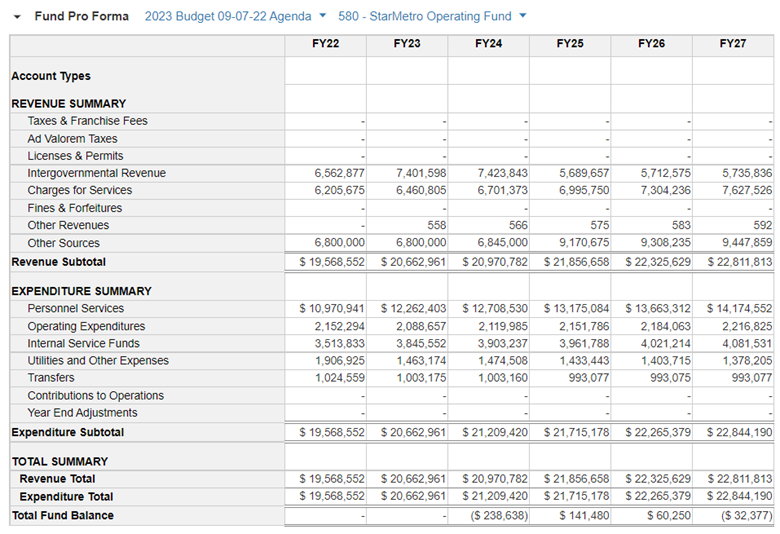

Budget Highlights

FY23

- The FY23 budget totals $20.6 million, which is $1.0 million, or 6%, higher than FY22. This change is due primarily to an increase in projected revenue from grants and the FSU bus contract revenue and increased personnel expenses for fixed-route service.

- The projected grant fund revenue of $7.4 million is an increase from last year's $6.6 million budget due to the increased application of Federal formula grant dollars to operating.

- The FSU bus contract revenue projection is $5.2 million, a significant increase over FY22 and pre-pandemic revenue, which previously peaked at $3.7 million in FY19.

- With pandemic-related revenue loss to the General Fund, its contribution to StarMetro decreased in FY22 to $3.8 million from the prior year's budget of $5.8 million. The transfer is being held at the same level for FY23. COVID-19 relief funds through CARES and ARPA funds have been used to supplement StarMetro's revenue, as well as an increase in federal formula grants for operating in FY23.

- StarMetro has 144.50 full-time equivalent (FTE) and 54 temporary employees. FTEs decreased by 2.00 from FY22 due to a position transferring to Administration and Professional Services and another moving to Customer Operations.

FY24-27

- Future budget projections assume a steady annual increase in ridership and fare cash and a steady decrease in Gas Tax revenue.

- Expenses for fixed route and Dial-A-Ride services are expected to increase yearly due to expected salary increases. The cost of fuel is a factor but is challenging to forecast.

- The General Fund contribution will remain around the FY22 level ($3.8 million) through ARPA funding's eligible use deadline of FY24 and then increase towards prior years' levels ($5.8 million).

- Continue to leverage grant funds and work with Fleet Management to purchase electric buses and convert all vehicles to electric by 2035.

- For capital projects and infrastructure, the department expects to complete the South City Transit Center and continue enhancing bus stops with its Blueprint allocation ($612,500 annually).

The City has operated StarMetro, a public transit system, since December 1973. StarMetro provides fixed route and special transportation services under the Americans with Disabilities Act (ADA) provisions and serves as the Community Transportation Coordinator (CTC) for Leon County. Public transportation services include weekday cross-town routes as well as university routes. StarMetro also provides individually scheduled per-request (para-transit) transportation to senior, disabled and low-income customers in Tallahassee and Leon County.

StarMetro heavily relies on personnel to accomplish its mission. StarMetro's primary goal is to meet the community's service needs within budgetary constraints by monitoring on-time performance and ridership levels monthly and quarterly, daily and weekly staffing levels.

StarMetro's vehicles and facilities comply with rules and regulations in the State of Florida Uniform Traffic Control Laws, Florida Administrative Code, Federal Motor Vehicle Safety Standards, and the Federal Transit Administration Policies and Procedures.

StarMetro regularly uses grant funds for capital projects and operating expenses. A combination of CARES Act, American Rescue Plan, Urbanized Area Formula Grants, and FL Department of Transportation (FDOT) grants have been used in recent years and will be used in FY23 to support operations. Assumptions for significant revenue sources for StarMetro in FY23 operating budget include:

- Gas tax revenue of $3.0 million

- Revenue from the FSU contract at its highest level yet of $5.2 million

- Federal Transit Authority formula grant 5307 funding of $4.8 million

StarMetro routinely evaluates how they can offset higher overtime personnel expenses by utilizing temporary employees and capturing salary savings. Additionally, they identify ways to boost hiring and retaining current staff (a common problem public transportation agencies face) within the budget.

See additional views of FY23 budget in OpenGov

See additional detail of the Five-Year Fund Pro Formas.

Estimated revenues and expenditures for FY23-FY27 generally reflect revenue projections and current expenditure levels escalated by a CPI factor and indicate how expected trends applied to current estimates will shape future budget planning.

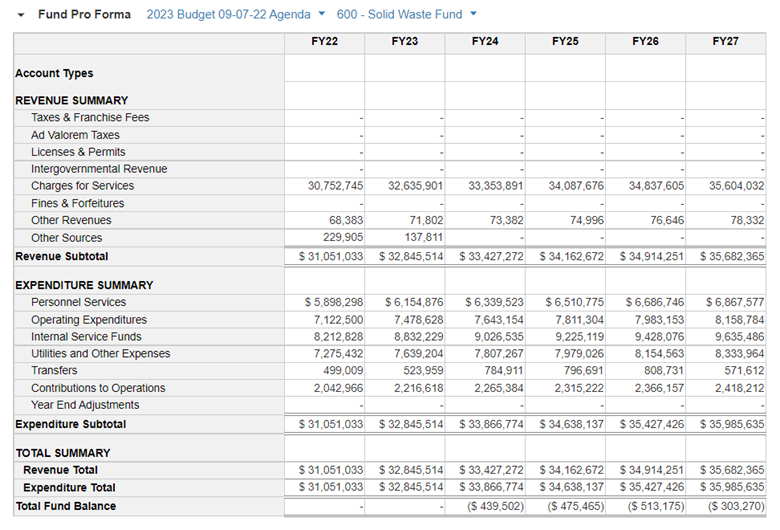

Budget Highlights

FY23

- The fund is self-sustaining, with monthly service charges paying for services.

- Solid Waste rates are reviewed every three to four years to ensure cost recovery over the planning period.

FY24-27

- Based on personnel costs, contractual provisions, revenues, and expenditures are estimated to increase from 1.8% to 3.1% from FY24-27.

- The City will complete a rate study for the Solid Waste Fund in FY23.

As part of the Community Beautification and Waste Management Department, the Solid Waste Fund provides removal and disposal of garbage, bulky items, yard waste, and recycling and recycling services for 50,000 residential and 15,000 commercial customers within the city limits.

See additional views of FY23 budget in OpenGov

See additional detail of the Five-Year Fund Pro Formas.

Estimated revenues and expenditures for FY23-FY27 generally reflect revenue projections and current expenditure levels escalated by a CPI factor and indicate how expected trends applied to current estimates will shape future budget planning.

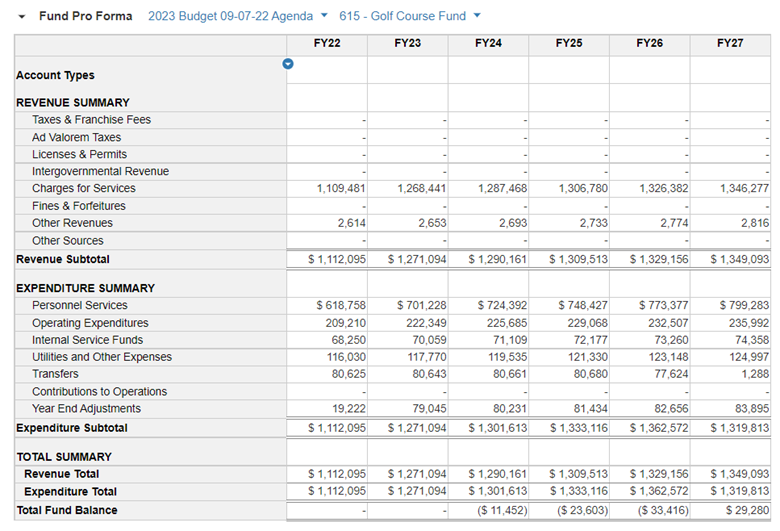

Budget Highlights

FY23

- Operating revenues and expenses were adjusted by CPI at 7% for FY23 and included a $3.6 million transfer to RR&I.

- Personnel cost increased by 9.25% over FY22 partially due to the reduction in capitalized wages and is mitigated by the $106 thousand budget reduction in the operating expenses.

- There is a 10.6% reduction in operating expenses as the fund is continually looking for savings to produce a year-end transfer to their RR&I fund for capital improvements.

FY24-27

- Revenues are held stable with the projected CPI of 1.5% and considered minimal customer growth.

- Operating expenses are also estimated at the projected inflation rate of 1.5% per year. A fee study is contemplated in the next few years to assess the long-term sustainability of the Utility.