FY2024

City of Tallahassee Annual Budget Report

Mayor and Commissioners,

I am pleased to present a City of Tallahassee Fiscal Year 2024 (FY24) balanced budget for your review and consideration. Under your guidance, we have established a solid foundation focused on achievement and fortified by our mission, vision, and organizational values. Thanks to sound fiscal management, I am proud that the cost paid by residents for municipal services in Tallahassee is the lowest among similar-sized peer cities in Florida. Looking forward, City services continue to remain affordable while supporting the high quality of life residents enjoy, expect, and deserve.

This balanced budget allocates resources toward our highest priorities, as established through consensus by you, the City Commission. It serves as a financial roadmap for how to accomplish the goals and initiatives outlined in the Five-Year Strategic Plan, which you unanimously approved. Under your leadership to date, 89% of the 134 targets have been achieved or are on target for completion. Progress on the plan means progress for our community and the City’s nearly 4,000 employees are proud to serve this community and make a positive impact daily.

Among your top priorities have been public safety, affordable housing, investing in infrastructure, and providing affordable utility services. Below are examples of accomplishments within these target areas from the past year.

Chief among our organization’s priorities is the City’s public safety. In recent years, the Commission has focused on proactive investment in long-term, systemic initiatives to address factors that contribute to violent crime in the community. These efforts include TEMPO, TFLA, TEAM, Neighborhood First plans, gun violence mitigation, the Capital Region Real Time Crime Center (RTCC), and the Council on the Status of Men and Boys. These programs total $31.5 million in new public safety investments over the past six years and an additional $7.8 million for the FY24 budget. They are achieving a transformative impact that is recognized nationally and continue to produce results. TEMPO has engaged more than 2,600 disconnected youth, with zero recidivism, surpassing the Strategic Plan objective of 2,100 youths engaged. TFLA has engaged nearly 1,100 youth, providing them summer jobs and lifelong skills. To further the meaningful impact being made through these public safety initiatives, the FY24 budget includes an additional $7.8 million in funding for these initiatives as well as a $9.5 million increase to the Tallahassee Police Department’s budget.

Investment in affordable housing is investment in a healthier community and a stronger economic future for us all. As a direct result of the City’s strategic policymaking, land use flexibilities, innovative programming, and leveraging unprecedented commitments of more than $18 million in federal, state, and local dollars, approximately 3,000 certified affordable housing units were recently constructed or are in the development pipeline locally. This is more than the number of affordable units built in the last 25 years combined. New affordable homes are just one piece of the puzzle. The City’s affordable housing programs have also helped keep nearly 3,600 people in their homes over the past five years through programs like down payment assistance, façade repairs, home rehabilitation, and homelessness prevention. This work represents just a portion of the $49.5 million invested in affordable housing efforts over the past five years.

The City’s public infrastructure and transportation networks connect our community, goods, and services through a system of roadways, walkways, and public transit facilities. The City’s 650 miles of roads are in good condition, and the current level of maintenance is adequate to maintain the standard conditions. The network of sidewalks continues to grow in line with the City’s strategic priority to add 10 new sidewalk projects each year. Recent new additions include Highland Street and Hillsborough Street. Local neighborhoods are on track to be more walkable than ever through the combined results of the City, Blueprint Intergovernmental Agency, and Community Redevelopment Agency projects.

Despite nationwide inflation and volatile fuel markets, the City’s utilities remain reliable and affordable. Monthly electric bills continue to beat the state average for both municipal and investor-owned utilities ($127.92 vs. $138.66 and $168.38, respectively). As a result, between April of 2022 and March of 2023, Tallahassee customers paid $91 million less for electricity than customers of other private utilities. Additionally, the Energy System and Consolidated Utility Systems have recently received Aa3 and AA+ bond ratings, respectively, signifying a low-cost burden and solid management practices. Tallahassee’s water quality continues to be among the best in the country. Water quality test results confirm exceptional quality for City water customers. Finally, the City continues to be a leader in the implementation of a clean energy future. Development of the Clean Energy Plan is nearing completion and will guide the City to 100% net, clean renewable energy by 2050.

Our accomplishments and steady progress during FY23 have established a strong footing for continued momentum. As work proceeds to achieve the ambitious vision of the Strategic Plan, in line with your direction, the budget recommends a millage rate increase of 0.4 mills to enhance public safety efforts. Our dedication to meeting the City Commission’s priorities is clear and reflected in this balanced budget.

FY24 Budget Development

This balanced budget is informed by Commission direction and public input into the FY24 budget provided through workshops (including three targeted budget workshops) and meetings. As shared above, the FY24 budget is also informed by the objectives and targets in the City’s Strategic Plan, which clarify the prioritization of resources.

As required by state law, the City Commission must adopt a balanced budget each year for all operating funds. At the three prior workshops, staff presented updates on the City’s 14 operating funds, including the 13 enterprise funds and the General Fund.

Since the May 24 workshop, staff has further refined budget projections based on newly available information and Commission confirmation of the assumptions presented. The FY24 balanced budget is guided by the following assumptions:

- Maintain existing levels of operating spending, staffing levels, and service levels for core general government services such as Parks, Recreation and Neighborhood Affairs (PRNA); Public Infrastructure; Housing and Community Resilience; and the Community Human Services Partnership (CHSP).

- Increase the Tallahassee Police Department (TPD) budget by approximately 14% ($9.5 million) to reduce violent crime. This additional funding will add 20 new officers; allow investment in advanced video, software, and artificial intelligence technology; and increase wages to ensure the ability to retain and recruit well-qualified sworn officers. When comparing cost per capita to peer Florida cities, TPD currently ranks 11 out of 12. The department operates, however, with only 52% of the national average of officers per capita, which strains vital public safety resources. The City’s ratio of sworn officers per 1,000 citizens has dropped since the 1990s when Tallahassee had 82% of the national average of officers per capita.

- Move our full time and OPS employees to a $16 per hour minimum wage, ensuring we are an employer of choice through a 5% across-the-board pay increase for the second year in a row, with a guaranteed $2,000 minimum increase for employees. Additionally, the FY24 budget maintains the average share of health plan costs for employees at 20%.

- Invest $7.8 million in wrap-around public safety initiatives including TEMPO, TFLA, TEAM, neighborhood safety programs, gun violence mitigation, the Real Time Crime Center, and the Council on the Status of Men and Boys. This will bring the total invested in these programs to $39.3 million since FY18

- Further key capital improvement projects like the second Senior Center, the Southside Transit Center, the Fire Station at Lake Bradford Road, and numerous sidewalk and road projects. The Capital Improvement Plan has a five-year budget of $1.07 billion

- Replenish the Special Insurance Reserve Fund.

General Fund Updates

This balanced budget reflects the most current projections for General Fund expenses and revenues, as discussed at the Commission’s three previous budget workshops, and recommends a millage rate increase of 0.4000 mills to support a 14% increase in the Tallahassee Police Department budget. FY24 General Fund expenses are expected to total $201 million. Revenues are expected to total $201 million, which includes the latest information reported by the Leon County Property Appraiser.

Leader in Public Service Delivery

In line with our mission to be the national leader in the delivery of public service, the City is continually recognized for best practices in financial and performance management by both professional associations and national credit rating agencies. The City also received the highest opinion that auditors can express on the City’s financial statements.

Our organization continues to set the bar in the state by leading among peer cities in the Municipal Cost Comparison. For example, the City continues to have the lowest electric bill and the lowest total cost of service, all while having 45% of properties exempted from the tax roll. Additionally, Tallahassee has more affordable housing units in the pipeline per capita than all MCC cities. Residents can be confident in our commitment to quality and affordability.

This balanced budget will maintain the City’s strong financial standing, exemplary service, and commitment to residents. At every level of the organization, the City and its employees remains dedicated to its mission, vision, and values. We are focused on achieving the targets outlined in the five-year Strategic Plan and doing good within the community. With my unwavering confidence in the City’s dedicated staff, and in accordance with the Commission’s leadership, the FY24 balanced budget is submitted for your consideration.

Sincerely,

Reese Goad

City Manager

FY2023 Budget Overview 1.0

Introduction and Overview

1.1 Mission

Through workshops, surveys, and commission retreats the City of Tallahassee has developed the following vision, mission, critical success factors. These are the basis for the performance measurement process that each department has implemented.

Mission:

To be the national leader in the delivery of public service.

Vision:

A creative capital city that supports a strong community with vibrant neighborhoods; an innovative economic and educational hub serving a diverse and passionate people, protecting our natural resources and preserving our unique character.

Values:

- Honor public trust through ethical behavior.

- Provide exceptional citizen service.

- Lead with integrity at every level.

- Collaborate to reach common goals.

- Invest in employee excellence.

- Promote equity and celebrate diversity.

1.2 Strategic Plan

In preparation for its bicentennial anniversary in 2024, the City developed a comprehensive 5-year strategic plan. The plan was developed with extensive citizen engagement, both in-person and online, direction from the City Commission, and the integration of more than 40 departmental and master plans. While the budget directs resources for accomplishing one year’s worth of goals and activities, this plan represents the City’s direction through 2024.

To read the complete 2020-2024 Strategic PLan and view the City's progress on the goals and objectives visit Talgov.com/PerformanceDashboard. You can also visit Talgov.com/YearInReview to read about the City's accomplishments during the last fiscal year.

To achieve the City's vision, the City Commission identified seven priority areas to guide service efforts. Each priority area, with its corresponding goals, objectives, and targets, is outlined below.

View Full Strategic Plan Dashboard Economic Development Impact on Poverty Organizational Effectiveness Public Infrastructure - City Utilities Public Infrastructure - Mobility Public Safety Public Trust Quality of Life

1.3 Budget Overview

The City is committed to allocating resources toward the City Commission and community's highest priorities; public safety, affordable housing, infrastructure investment, and affordable utility services. Click below to see examples of accomplishments within these target areas from the past year.

Short Term Factors

The City's FY24 Budget totals $1.1 billion, which includes $868.4 million for operating expenses and $253 million for capital investment. It was developed through a year-round, multi-stage process involving public participation, City Commission input, and a focus on the priorities outlined in the City's Strategic Plan.

For the FY24 Budget, significant factors in the short term that impact services and citizens include:

Employer of Choice

Our priority to be the industry leader in providing public services requires recruiting, hiring, and retaining the best employees. In FY24, to ensure we are the employer of choice in a competitive labor market, employees will receive a minimum increase of $1,900 for those making less than $38,000, for those making more than $38,000, a 5% across-the-board increase for general employees, and a competitive package for our Police collective bargaining units. Competitive pay supports the City's other strategies for the workforce:

Public Safety

Increased the Tallahassee Police Department (TPD) budget by approximately 14% ($9.5 million) to reduce violent crime. The additional funding will add 20 new officers, allow investment in advanced video, software, and artificial intelligence technology, and increase wages to ensure the ability to retain and recruit well-qualified sworn officers. When comparing cost per capita to peer Florida cities, TPD currently ranks 11 out of 12. The department operates, however, with only 52% of the national average of officers per capita, which strains vital public safety resources. The City's ratio of sworn officers per 1,000 citizens has dropped since the 1990s when Tallahassee had 82% of the national average of officers per capita.

FY24 is the second year of a five-year investment to combat Gun Violence, with $1 million a year in directed funding for programs designed to interrupt the cycle of violence through local partnerships.

Affordable Housing

Investing in affordable housing is investing in a healthier community and a more robust economic future. Due to the City's strategic policymaking, land use flexibilities, innovative programming, and leveraging unprecedented commitments of more than $18 million in federal, state, and local dollars, approximately 3,000 certified affordable housing units were recently constructed or are in the development pipeline locally. Three thousand units is more than the number of affordable units built in the last 25 years combined. New, affordable homes are just one piece of the puzzle. The City's affordable housing programs have also helped keep nearly 3,600 people in their homes over the past five years through programs like down payment assistance, façade repairs, home rehabilitation, and homelessness prevention. This work represents just a portion of the $49.5 million invested in affordable housing efforts over the past five years.

Public Infrastructure

The total capital budget for FY24 is $253 million, which funds critical investments in the City's infrastructure. Public infrastructure and transportation networks connect our community, goods, and services through roadways, walkways, and public transit facilities. The City's 650 miles of roads are in good condition, and the current level of maintenance is adequate to maintain the standard conditions. The network of sidewalks continues to grow in line with the City's strategic priority to add ten new sidewalk projects each year. Recent new additions include Highland Street and Hillsborough Street. Local neighborhoods are on track to be more walkable than ever through the combined results of the City, Blueprint Intergovernmental Agency, and Community Redevelopment Agency projects.

Also included in the $253 million investment are capital improvements to our utility systems, contributing to their service and safety reliability. Overall, capital investments are directed by the Strategic Plan and support its objectives:

Fuel Cost Management

Despite nationwide inflation and volatile fuel markets, the City's utilities remain reliable and affordable. Monthly electric bills continue to beat the state average for both municipal and investor-owned utilities ($127.92 vs. $138.66 and $168.38, respectively). As a result, between April 2022 and March 2023, Tallahassee customers paid $91 million less for electricity than customers of other private utilities.

Continued fuel cost management is a priority that ensures that electric and gas customers pay less for power by forecasting and monitoring economic trends and market costs. In addition to providing community savings, fuel management supports Strategic Plan goals for financial planning.

The FY24 Budget reflects the City's commitment to respond to these immediate needs in the short term.

Economic Factors

Significant economic factors impacting the FY24 budget include:

- Workforce costs will remain high through FY24, and our strategy of providing competitive wages will help the City recruit, hire, and retain the best employees.

- While inflation has slowly moved from the prior year's average of 8% to 3.7% in October, the cumulative impact on costs will continue to impact fuel, contracts, supplies, and equipment due to inflation and the slow post-pandemic recovery of the supply of goods and the supply chain in FY24.

- While gas prices have decreased since their peak in April 2022, they have not returned to pre-pandemic prices, which inflates the City’s fuel purchase expenses but also contributes to the cumulative impact driving the cost for contracts, supplies, and equipment due to inflation and the slow post-pandemic recovery of the supply of goods and the supply chain in FY24.

The City's priorities, as presented in the Strategic Plan, are shown below with direct links to the Strategic Plan document to provide more detail.

These principles guide budgetary planning. The City will continue prioritizing investment in targeted areas highlighted by the strategic plan and the City Commission.

1.4 Millage Rate

The millage rate is the amount per $1,000 used to calculate ad valorem taxes (property taxes). The rate is multiplied by the total taxable value to determine the property taxes due.

The millage rate is used to calculate ad valorem taxes (property taxes) due by each property owner. The rate is expressed as dollars per $1,000 of taxable property value.

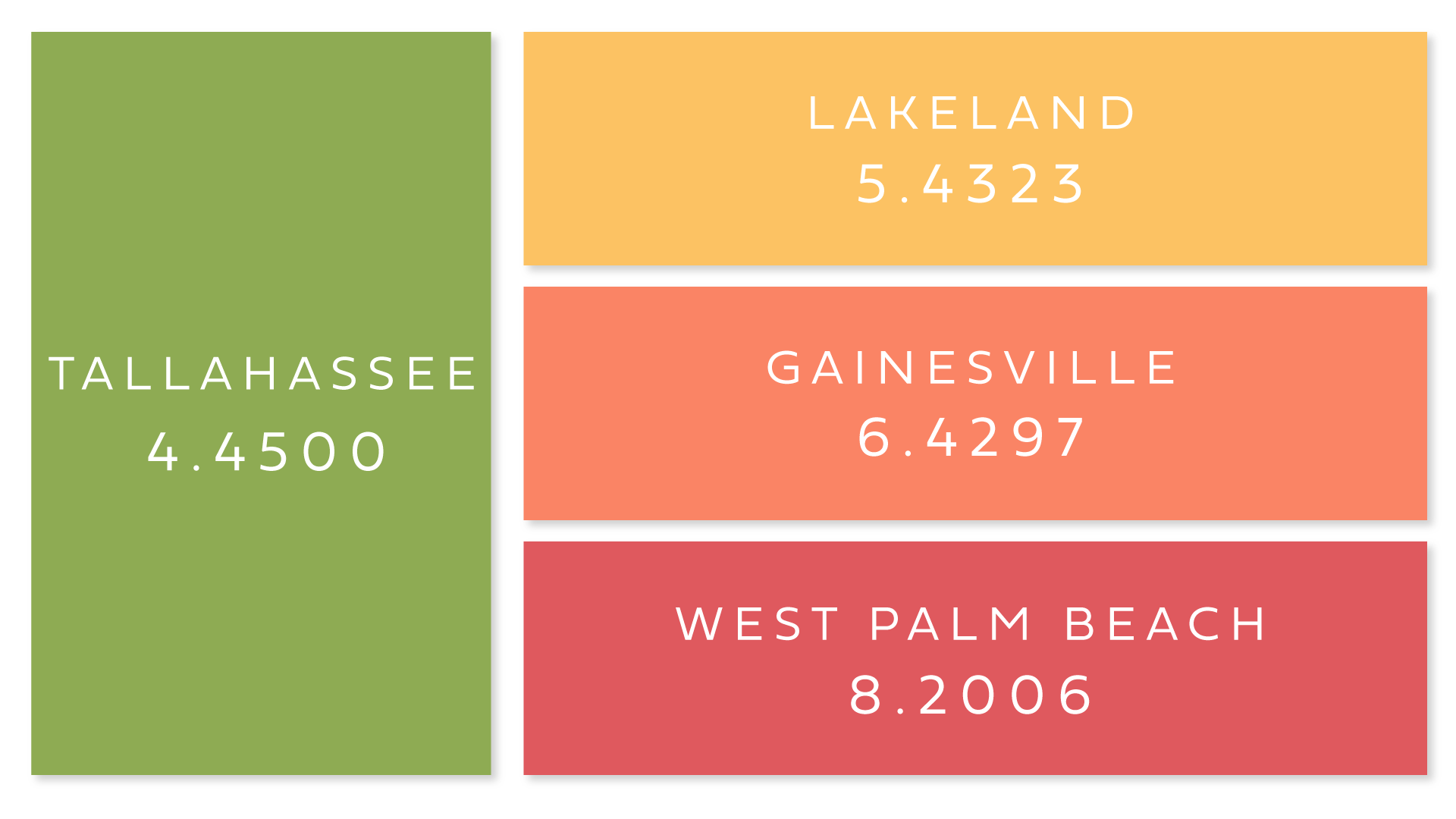

The City of Tallahassee’s millage rate is 4.45, an increase over the 4.10 rate held for the past seven years. Additional property tax revenue to the City’s General Fund will enhance public safety efforts carried out by the Tallahassee Police Department, which has operated with just 52% of the national average of officers per capita. The impact of this millage adjustment is that most property owners will see a monthly increase in ad valorem taxes of $3.50 or less and a majority of multi-family property units will see an increase of $2 or less.

The City’s millage rate of 4.45 mills is among the lowest of the 20 largest cities in Florida. It is the third lowest of the 12 cities in the Municipal Cost Comparison, an annual study of costs of living and doing business in municipalities across Florida. The chosen cities share similarities to Tallahassee in population, range of services provided, and rate of taxable property. Below is Tallahassee compared with four of those cities, including Gainesville and Lakeland.

A low millage rate keeps the cost of homeownership affordable while still providing high-quality services.

1.5 Municipal Cost Comparison

When measuring costs to citizens, the City compares itself to a group of eleven cities that share similar demographics, services provided, and square miles served. The Municipal Cost Comparison below contrasts what citizens, both residential and commercial, pay for municipal services.

City utilities undergo regular fee studies to ensure that costs for services are recovered and paid for by those that benefit. The municipal cost comparison, however, demonstrates the competitiveness of rates compared to peer cities across the state. The City ranks as one of the most affordable to citizens year after year.

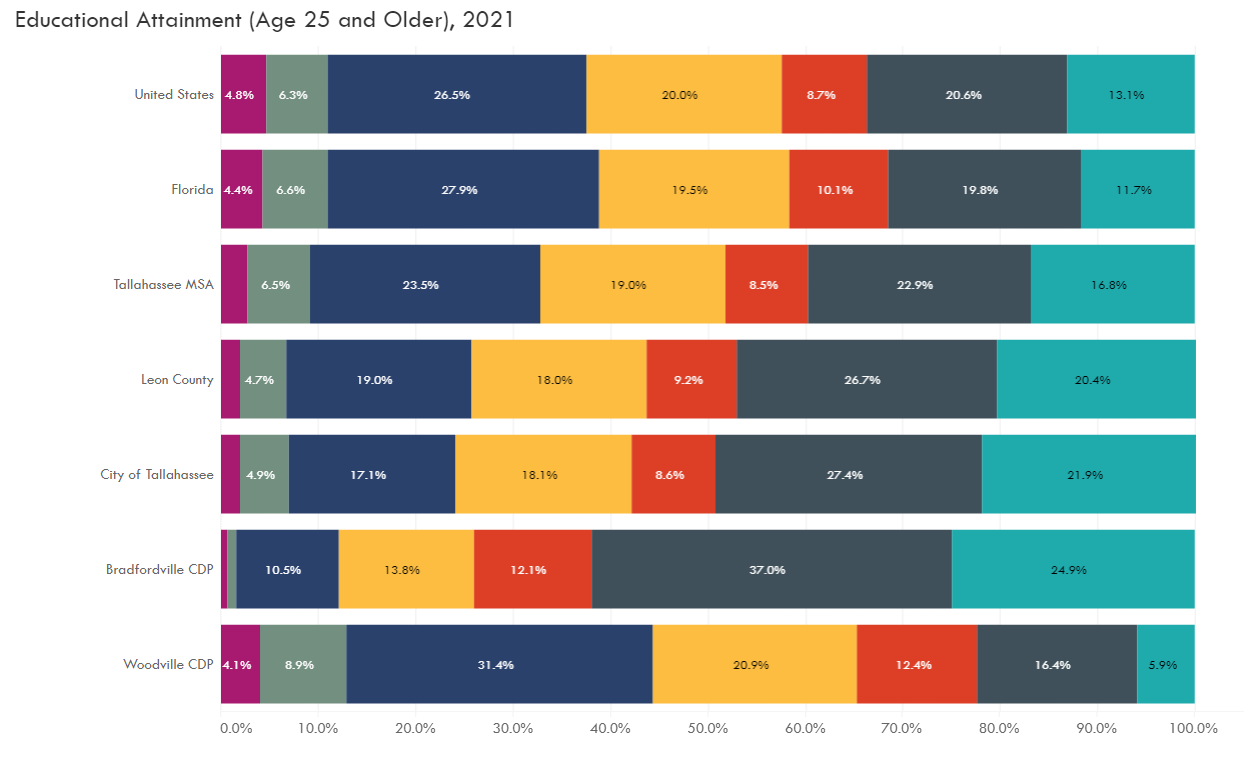

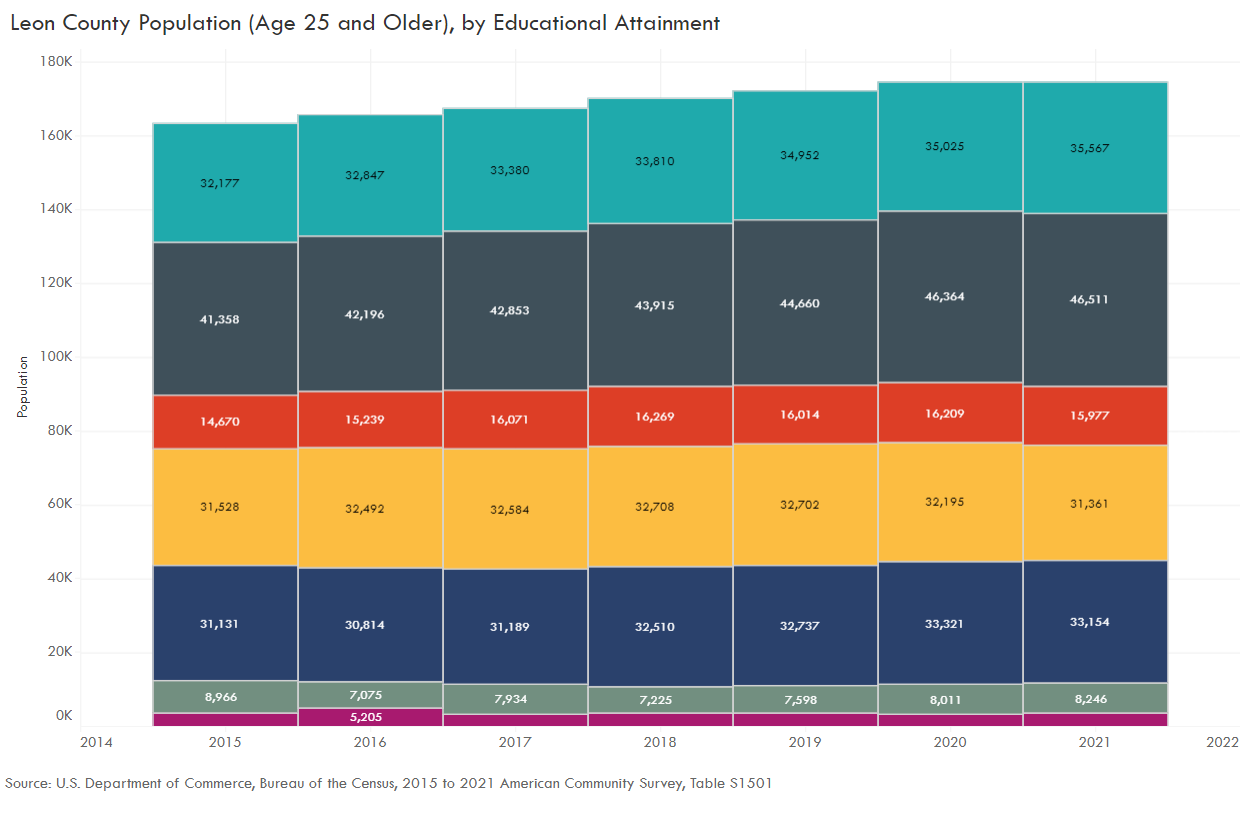

1.6 Population & Other Community Statistics

Tallahassee experiences consistent population growth. The City plans for a continued increase of its services. When making infrastructure decisions, the organization considers not just today’s demands but also tomorrow’s needs.

To view other statistics and trends that formulate the budget and plans for the City, please click here to read the Supplemental Demographic and Economic Information section.

FY2023 BUDGET OVERVIEW 2.0

STRUCTURE, POLICY AND PROCESS

2.2 Fund Descriptions & Structures

A fund is an accounting entity that documents activities. Fund accounting prioritizes accountability over profitability. Separate funds ensure revenues are appropriately related to expenditures.

Government funds support core city services where those paying indirectly benefit from the services. Enterprise funds are self-supported by user fees and charges. These operate similarly to private businesses.

Below are summaries of appropriated funds.

General Fund

This fund supports many core city services, including police, parks and recreation, road maintenance, housing initiatives, economic development, land use, environmental regulation, and animal services. The general government also provides an operating subsidy to Star Metro, the City's transit system.

Fund Type

Government

Surplus

City policy determines the use of any operating fund surplus at year-end and a target level for the deficiencies reserve. Any surplus at year-end is first added to the deficiencies reserve until the amount reaches the target. After fully funding the deficiencies fund, any remaining balance supports the subsequent year’s operating budget, up to a maximum of 5% of general government operating expenditures, and to buy down debt-financed capital improvement projects.

General Fund Transfer

$4.3 million in new funding is budgeted to support projects in FY24.

Operating Reserve

The FY24 revenue budget does not include transfers from General Fund Operating Reserves.

Other

Deficiencies Reserve: If the subsequent fiscal year ends with an operating deficit due to unforeseen circumstances, up to 5% of FY24 year-end surpluses will be available from the Deficiencies reserve as needed.

Fleet Reserve: The FY24 contribution is $2.2 million

RR&I: Undesignated balance set at a maximum of 3% of general government capital projects.

The Growth Management Department is responsible for enforcing the City’s building codes through the review of building plans, permitting, and the inspection process. Specific actions include ensuring that planned construction complies with applicable codes, authorizing utility connections and issuing certificates of occupancy, providing centralized intake and coordination of all permit applications, administering contractor licensing regulations, and enforcing the rooming house ordinance.

Fund Type

Enterprise

Surplus

To the extent available and appropriable, all year-end surpluses will be retained within the fund and made available for operating expenses and capital projects.

Operating Reserve

The FY24 revenue budget does not include transfers from operating reserves.

Other

Not applicable.

Established in 1902, the Tallahassee Fire Department (TFD) is a municipal fire department that provides fire suppression and emergency medical services in the City and the unincorporated areas of Leon County, Florida. The department protects lives, property, and the environment from hazardous conditions threatening our community. This mission is accomplished by providing prevention and protective services specific to the incident need.

Fund Type

Enterprise

Surplus

Retained for fire operating and capital costs.

General Fund Transfer

No transfer.

Operating Reserve

No reserve.

Other

Not applicable.

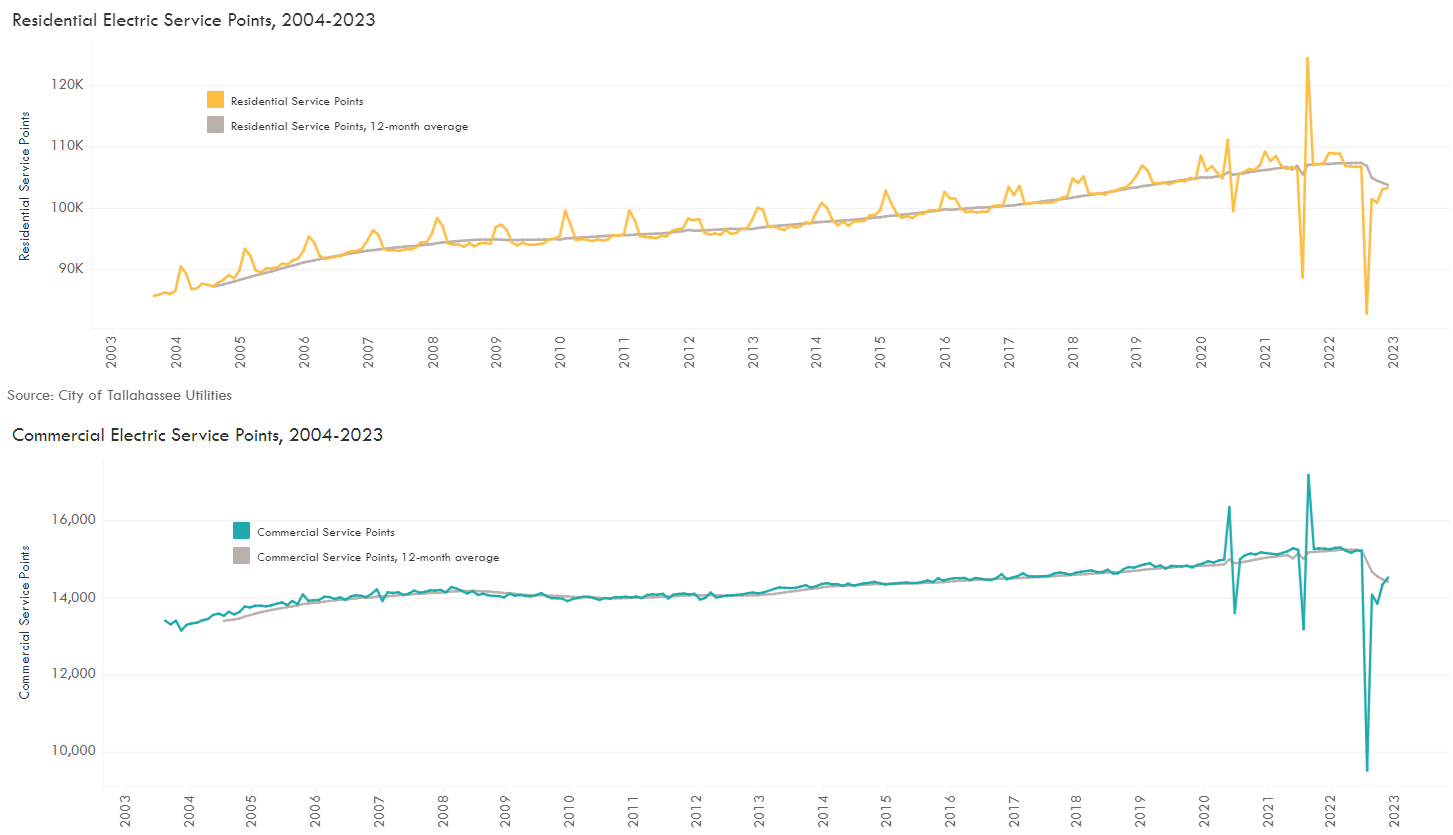

The Electric Utility serves over 128,000 customers in a 221-square-mile service territory. It is the fourth-largest municipal electric utility in Florida and the 27th-largest of over 2,000 municipal systems in the United States. The utility comprises six significant divisions: Finance and Administration, Power Delivery, Energy Supply, System Operations, System Compliance, and System Integrated Planning. The Electric Utility develops a 10-year sales forecast annually to use in the annual budget process.

Fund Type

Enterprise

Surplus

Operating fund balance after General Fund transfer minus bond reserves used to fully fund the operating reserve, with the balance designated for electric system capital projects.

General Fund Transfer

The transfer is based on CPI. The transfer for FY24 is $36.8 million.

Operating Reserve

The operating reserve comprises four subcomponents, with the primary purpose of providing working capital. The working capital component is targeted to having a balance of 60 to 90 days of operating expenses. The other three components are fuel risk management, emergency reserve, and rate stabilization.

Other

RR&I: RR&I: Transfer budgeted at a level equivalent to depreciation expense as provided in the Comprehensive Annual Financial Report (CAFR).

The City of Tallahassee's Natural Gas Utility has provided clean, safe, economical, and reliable natural gas to residents and businesses in a growing service area for over 60 years. The utility safely provides natural gas energy through hundreds of miles of underground gas mains, which serve over 34,000 customers in the Leon, Gadsden, and Wakulla areas. The highly trained staff works to ensure the distribution system's integrity and dependability and assist customers with energy conservation and cost savings through natural gas use.

Fund Type

Enterprise

Surplus

Designated to fund the operating reserve fully and, after that, to fund gas system capital projects

General Fund Transfer

The transfer is based on CPI. The transfer for FY24 is $3.5 million.

Operating Reserve

Funded at 25% of the previous year’s General Fund transfer and used to meet General Fund transfer, if required.

Other

RR&I: Transfer budgeted at a level equivalent to depreciation expense as provided in the applicable rate study.

Approximately 88,000 service points are connected to the City’s water distribution network that provides potable water to essentially all developed areas in the City and certain contiguous county areas. More than 9 billion gallons are produced annually by an around-the-clock operation that utilizes 27 water production facilities, eight elevated storage tanks, 7,364 fire hydrants, and 1,245 miles of water distribution pipes.

Fund Type

Enterprise

Surplus

Designated to fund the operating reserve fully and, after that, to fund water system capital projects.

General Fund Transfer

The transfer is based on CPI. The transfer for FY24 is $4.3 million.

Operating Reserve

Funded at 25% of the previous year’s General Fund transfer and used to meet General Fund transfer, if required.

Other

RR&I: Transfer budgeted at a level equivalent to depreciation expense as provided in the Comprehensive Annual Financial Report (CAFR).

The City’s Wastewater Utility is responsible for collecting, treating, and recycling wastewater and for treating commercially pumped sewage. As part of the City’s commitment to protecting the environment, treatment processes utilized at the Thomas P. Smith (TPS) Advanced Water Reclamation Facility result in effluent that meets and exceeds regulatory requirements. On average, the wastewater system collects and treats more than 17.2 million gallons per day.

Fund Type

Enterprise

Surplus

Designated to fund the operating reserve fully and, after that, to fund sewer system capital projects.

General Fund Transfer

The transfer is based on CPI. The transfer for FY24 is $5.9 million.

Operating Reserve

Funded at 25% of the prior year’s General Fund. Used to meet General Fund transfer, if required.

Other

RR&I: Transfer budgeted at a level equivalent to depreciation expense as provided in the Comprehensive Annual Financial Report (CAFR).

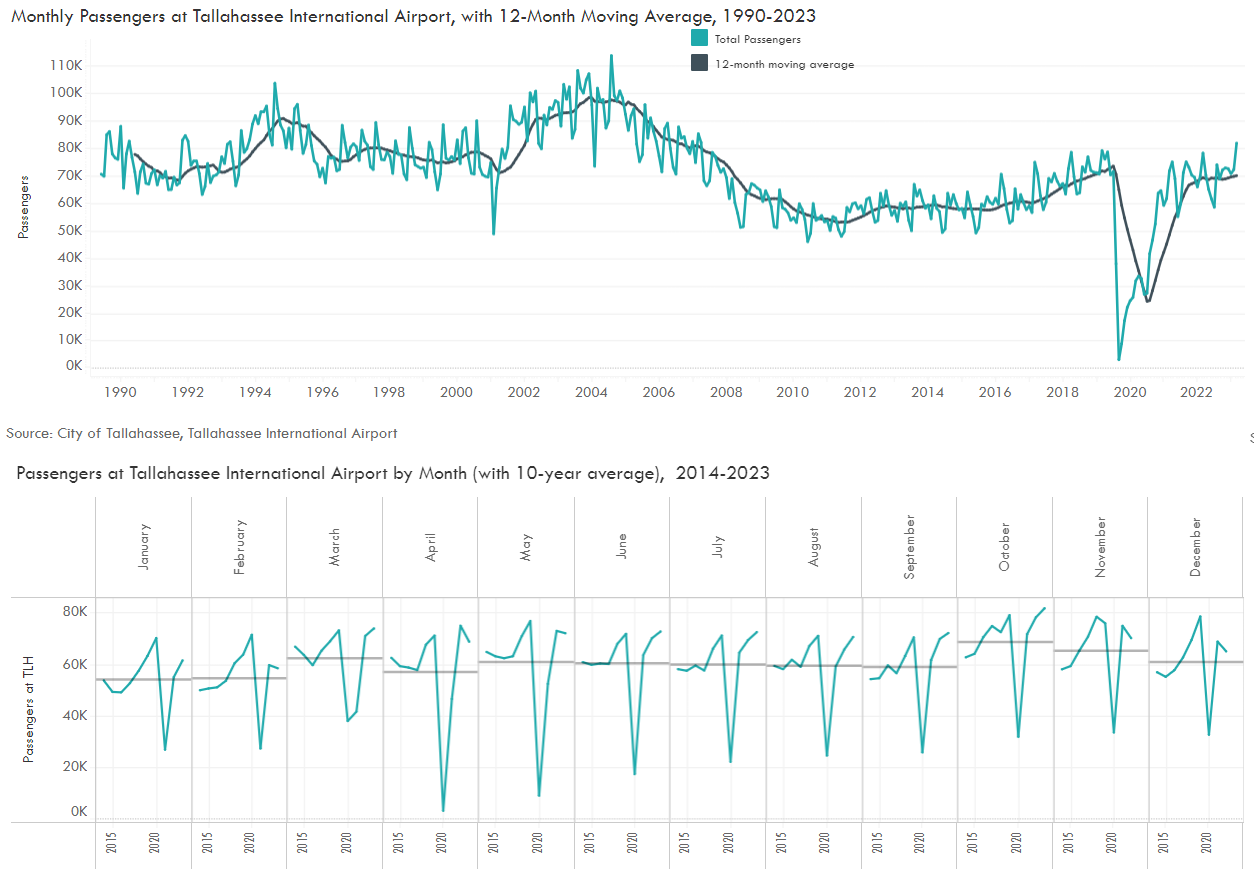

The Aviation Fund supports operations at the Tallahassee International Airport (TLH), including the Aviation Department’s six divisions and the Airport Police and Airport Parking divisions. The Fund also contributes to the Fire Fund for the Tallahassee Fire Department’s operations at the Airport.

The Airport hosts three airlines (American Airlines, Delta Air Lines, and Silver Airways) that deliver non-stop service to seven destinations and provide amenities to customers, including valet parking, long- and short-term parking, a cell phone parking lot, rental car options, a public waiting area, business center, dining options, and more. Airport staff also announced JetBlue’s intent to serve Tallahassee International Airport with direct air service to and from Fort Laurderdale-Hollywood International Airport. To continue the five-year goal of making a $1 billion annual economic impact, the Tallahassee International Airport continues the construction of an International Passenger Processing Facility while working to complete the necessary steps to become an authorized Foreign Trade Zone.

Fund Type

Enterprise

Surplus

Retained within the fund and allocated according to the airline use agreement.

General Fund Transfer

No transfer to General Fund. Full recovery of cost.

Operating Reserve

A minimum of 1/12th of the Airport's operating and maintenance budget is designated for unanticipated non-recurring expenditures.

Other

RR&I: Not applicable.

StarMetro, the public transit service for the City of Tallahassee, operates 14 weekday cross-town routes, including university service for Florida State University (FSU) and student ridership programs for Florida Agricultural & Mechanical University (FAMU), Tallahassee Community College (TCC) and K-12 students in Leon County.

The Fixed Route and Para-transit department provides accessible, equitable, and efficient transit services to citizens of Tallahassee, visitors, and commuters. Transit services are provided 363 days a year and assist in emergency situations as needed.

Fund Type

Enterprise

Surplus

Retained within the fund for operating expenses and capital projects.

General Fund Transfer

Transfers in from the General Fund support StarMetro operational deficits, when necessary.

Operating Reserve

No Reserve.

Other

RR&I: Not applicable.

The Solid Waste Fund provides garbage, recyclable materials, bulk, and yard waste collection for all residential customers citywide, and garbage and recyclable materials collections for commercial customers. Currently, the City serves 51,572 residential, 25,308 commercial, and 1,835 commercial recycling service points. Services include:

- residential bi-weekly curbside collection of bulky items, yard waste, electronics, and white goods,

- dumpster services for commercial customers collected by front-end loading trucks at night, up to six times per week,

- commercial container service with roll-off or hook trucks up to six times per week,

- commercial recycling up to five days per week, as well as other enhanced services, and,

- dead animal removal.

Fund Type

Enterprise

Surplus

Retained for rate stabilization reserve.

General Fund Transfer

Each year the transfer is increased by CPI. The transfer for FY23 is $2.3 million.

Operating Reserve

No Reserve.

Other

RR&I: Not applicable.

The Stormwater Fund manages and develops infrastructure for drainage, flood prevention, and retention of stormwater run-off to prevent pollutants from entering the aquifer. Work includes capital project oversight, maintenance of drainage infrastructure such as retention ponds and drainage outfalls, monitoring of lakes and groundwater, and raising public awareness of the environmental impacts of pollution, such as the Think About Personal Pollution (TAPP) program. The Stormwater Utility serves 77,000 residential customers and 6,000 non-residential customers through operational activities and the design and construction of drainage facilities infrastructure. This includes the maintenance of drainage facilities and ponds throughout the City.

Fund Type

Enterprise

Surplus

Retained for stormwater system capital projects.

General Fund Transfer

The transfer to the General Fund represents administrative cost sharing only.

Operating Reserve

No Reserve.

Other

RR&I: Maximum of 5% of capital projects funding sources, with a minimum level of 3%.

The Golf Fund supports Hilaman Golf Course, which offers a community-wide golf experience through daily rounds, driving range use, charity events, tournaments, and more. Hilaman also has a Pro Shop, restaurant, and outdoor deck area that provide a well-rounded experience. The course is open daily from 7:30 a.m. until dark, and course operations are led by a General Manager and two full-time staff members: a foreman and a course maintenance supervisor. In addition, Hilaman has over two dozen part-time employees who help with various day-to-day operations.

Fund Type

Enterprise

Surplus

Retained for Golf operating and capital costs.

General Fund Transfer

No transfer.

Operating Reserve

No reserve.

Other

Not applicable.

View full schedule of major and nonmajor funds.

View matrix of the relationship between departments and funds.

2.3 Basis of Budgeting

Budgets for general operation funds (General, StarMetro, and Golf Course Funds) are prepared on a modified accrual basis. The obligations for these funds (i.e., outstanding purchase orders) are considered expenditures, but revenues are recognized only when they are measurable and available. At the end of the fiscal year, open encumbrances are reported as reservations of fund balance. The operating budget does not include expenses for depreciation.

The budgets for the City’s utilities (Electric and Underground) and other enterprise funds (Aviation, Building Inspection, Solid Waste, Fire, and Cemeteries) are budgeted on a full accrual basis. Expenditures are recognized when a commitment is made (e.g., through a purchase order). Revenues are also recognized when they are obligated to the City, such as when utilities distribute bills.

The basis of budgeting is the same as the basis of accounting used in audited financial statements. Budget and accounting procedures are subject to modifications to comply with generally accepted accounting principles (GAAP) and the Governmental Accounting Standards Board (GASB) standards.

2.4 Internal Policies

There are several statutory requirements, internal policies, and other provisions that direct the development of the budget and its implementation throughout the year.

Florida Statutes, Chapter 166 – This statute authorizes municipalities to levy taxes, issue licenses, and set user fees to raise money necessary to conduct municipal government activities. This chapter also requires that local governments adopt a balanced budget. The tentative balanced budget must be posted on the municipality’s official website at least 2

days before the budget hearing, held pursuant to s. 200.065 or other law, to consider such budget. The final adopted balanced budget must be posted on the municipality’s official website within 30 days after adoption.

Comprehensive Plan – The Tallahassee-Leon County 2010 Comprehensive Plan was originally adopted by ordinance in FY 1990 and is updated with biannual amendment cycles. The Plan includes capital improvements, transportation, historic preservation, utilities, recreation, and other elements which provide a framework for allocating budget resources. The Capital Projects Summary consists of a listing of capital projects that address Comprehensive Plan initiatives by eliminating deficit levels of services or by maintaining existing levels of service.

Financing Policy, No. 224 Commission Policies – The financing policy establishes guidelines for the distribution of year-end surpluses, transfers from the utilities to the General Fund, types and amounts of operating reserves, and funding for capital projects from undesignated fund balance year-end revenues. The policy also provides for full recovery of cost for enterprise funds, limits non-utility fee increases to a maximum of 20% per year unless otherwise approved by the City Commission, and allows discount fees for recreational programs for youth, seniors, and disabled citizens. The “Finance Policy Summary” chart shows the policy's requirements as applied to each fund.

Risk Management Policy/Self-Insurance, No. 214 Commission Policies – This policy creates an internal service fund for payment of anticipated claims and judgments for coverage areas defined in the policy. In addition, a special Insurance Reserve Fund is established and funded to meet unanticipated losses from catastrophic events or claims in excess of the Risk Management Fund. This reserve is set at 150% of the average claims for the past five years or $3,000,000, whichever is greater.

Capital Project Management, No. 218 Commission Policies – This policy provides for the preparation of an annual capital budget and a five-year capital improvement plan. The policy also defines the roles and responsibilities of city departments and management regarding contracts, supplemental appropriations, expenditures, and project administration. The use of capital project overhead charges as an operating budget funding source also is established by this policy.

Local Option Sales Tax Management, No. 232 Commission Policies – This policy establishes the authority to provide advance funding for local Florida Department of Transportation (FDOT) projects for any project or project phase included in the FDOT five-year work plan. It allows for advance funding without an agreement for repayment after conducting a public hearing. The policy also authorizes using short-term debt to cover cash flow shortages that may result from this practice.

Debt Management Policy, No. 238 Commission Policies – The debt management policy, along with an analysis of the city’s compliance with the policy, is included in the capital budget summary and the capital improvement plan. Section 104 of the City Charter also specifies that general obligation debt will not exceed 20% of the assessed taxable valuation. Florida Statutes require that general obligation bonds be approved by referendum. The city currently does not have any general obligation bonds.

Vehicle Replacement Reserves – Funding for vehicle replacement is included annually in the capital budget. Vehicle replacement charges for a proportionate share of these costs are allocated based on equipment usage.

Bond Covenants – Before 1998, provisions of Bond Resolutions required that a minimum of 5% of prior year gross revenues be budgeted annually for Renewals, Replacements, and Improvements (RR&I) for system improvements in the utility systems. Covenants for the Energy System (electric and gas) bonds issued after 1998 do not specify an explicit amount or methodology but require a transfer to an RR&I fund.

Union Agreements – Currently, unions represent 634 authorized positions. A total of 356 positions are subject to terms and conditions of the collective bargaining agreement with the Big Bend Chapter of the Florida Police Benevolent Association, Inc. (PBA), and 278 positions are subject to terms and conditions of the collective bargaining agreement with the International Association of Firefighters (IAFF). Union agreements are generally negotiated every three years. FY23 is the last year of the current contract for all bargaining units.

Utility Rate Studies – Rate studies are prepared for each utility enterprise operation (electric and underground utilities) every three to five years on a rotating basis. Revenue projections are prepared using historical weather patterns and other growth factors.

Assessment and Fee Reviews – Fees and assessments are periodically reviewed to ensure recovery of costs to provide certain services. A cost of services study for the animal shelter was conducted in 2006, which recommended a plan to recover at least 50% of the operating costs through animal licensing fees, but this has not been implemented. The City Commission also increased building inspection fees in August 2009 to recover all eligible building inspection costs. Rates for electricity, underground utilities, and solid waste are set by ordinances that provide for annual increases based on the CPI.

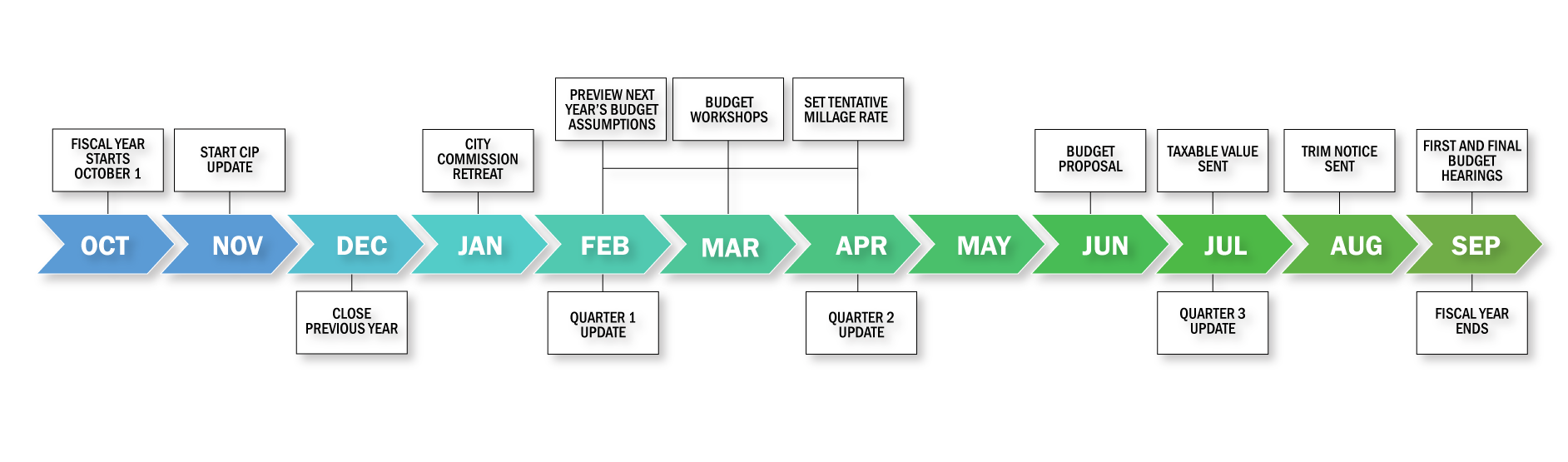

2.5 Budget Calendar

Important Dates

|

|

December 7, 2022

Approval of Fiscal Year 2022 Budgetary Closeout

Read the agenda item

Commission Discussion

|

|

January 18, 2023

City Commission Retreat

Read the agenda item

Commission Discussion

|

|

February 8, 2023

Budget Workshop

-

FY2023 First Quarter Budget Update & FY24 Budget Plan

Read the agenda item

Commission Discussion

|

|

April 26, 2023

Budget Workshop

-

FY2023 Second Quarter Budget Update & FY24 Budget Plan

Read the agenda item

Commission Discussion

|

|

May 24, 2023

Budget Workshop

–

FY2024 Budget Plan

Read the agenda item

Commission Discussion

|

|

June 14, 2023

Budget Workshop

–

FY2023 Third Quarter Budget Update, FY2024 Proposed Budget, &

Approval of Tentative Millage

Read the agenda item

Commission Discussion

|

|

September 13, 2023

Final Public Hearing on the FY23 Budget Plan and FY23 CHSP funding allocations; First and Only Public Hearing on Ordinance 22-O-19; First and Only Public Hearing on Ordinance No. 22-O-24

Read the agenda item

Commission Discussion

|

|

September 27, 2023

Second of Two Public Hearings on the FY2024 Budget Plan

Read the agenda item

Commission Discussion

|

2.6 Budget Process

The budget process involves collaboration and coordination among city departments, Resource Management, executive leadership, the City Commission, and the citizens of Tallahassee. It results in annual operating budgets, capital budgets, and a five-year financial and capital improvement plan for the General Fund and enterprise funds. While the fiscal year begins on October 1st, the budget is a continuous cycle.

The City holds several budget workshops throughout the year. These serve the dual purpose of updating for the current fiscal year and the next budget cycle. Workshops are less formal city commission meetings that do not include a litany of items for the commissioners to address. Instead, the workshop allows for a focused discussion on the topic.

At the first quarter workshop, Resource Management reports on the early status of its funds to the Commission for the current budget cycle. It also presents some initial assumptions to work toward for the next one. This includes proposing an initial millage rate and employee raises, benefits, and other items.

At the second quarter workshop, assumptions are reaffirmed, and priorities are addressed. Issues with the current year’s funding can be addressed while taking a stronger look at the upcoming year.

Resource Management presents a proposed budget for the following fiscal year at the third quarter workshop. These include most of the capital projects, priorities, and changes. Any significant issues for the current budget year are also addressed at this workshop.

The City maintains a “hold the line” philosophy when budgeting for departments’ operating costs. Budgets for things such as office supplies or contracts are not increased every year. Without automatic increases in budgets, staff innovate for cost savings annually. Departments evaluate procedures to be more efficient.

Hold the Line counters a classic budgeting issue known as “use it or lose it.” In older budgeting techniques, departments are incentivized to spend their budget entirely and use their resource depletion to justify maintaining their budget levels. Sometimes the spending would persuade for even higher budgets the following year. With Hold the Line, Resource Management assures departments that their budget levels are safe. This approach leads to less spending overall as departments do not spend money merely to defend their allocations.

At the 1st quarter budget workshop, staff present initial assumptions to the City Commission for the next budget year. These include two major items: millage rate and staff pay raises.

For the City to be a leader in public service, it must recruit, train, and retain the best people. The City has a history of regular increases for staff ranging from two to three percent. This accommodates the cost of living increases, but the commitment can attract the best employees to the organization.

Departments are responsible for developing their respective budget requests with support from Resource Management. City Commission budget workshops are held throughout the year to discuss policy issues and the long-term ramifications of budgetary decisions. The City Commission adopts a tentative millage rate for assessing ad valorem taxes in early July, as state statutes require. The final budget and the millage rate are adopted by resolution during the month of September, following two statutorily required public hearings.

The City’s budget is appropriated at the fund level. Revenues are budgeted at the fund level only, while Department expense budgets are contained within one or more cost centers. There are currently nearly two hundred cost centers across all departments.

Budgetary control is maintained at the department level, with Resource Management providing support. In accordance with the city’s budget transfer policy, departments can amend budgets in various ways depending on the type of transfer being considered.

Any budgetary amendment within the department’s appropriated budget and within the same fund can be authorized by the City Manager. Transfers between departments that cross funds or increase appropriations are made at the request of the City Manager and must be approved by the City Commission.

Budgetary amendments between divisions and within the same fund may be initiated at the department head's discretion, except for transfers affecting specific categories such as personnel. Requests for amendments to the line item exceptions are reviewed by Financial Management and approved by the City Manager or respective appointed official for transfers affecting the offices of the City Attorney, Inspector General, or City Treasurer-Clerk.

Since implementing the PeopleSoft financial system, budgetary control has moved from the line-item level to the major budget category. In classic line-item budgeting, departments cannot spend more than a certain amount on very specific categories. This tended to limit flexibility, and governments could not adapt to problems that arose throughout the year. Now, departments may over-expend line items provided balances are available in the respective major budget category. This allows for greater managerial flexibility. Department heads can respond to citizens’ needs without dense bureaucratic processes.

FY2023 BUDGET OVERVIEW 3.0

FINANCIAL SUMMARIES

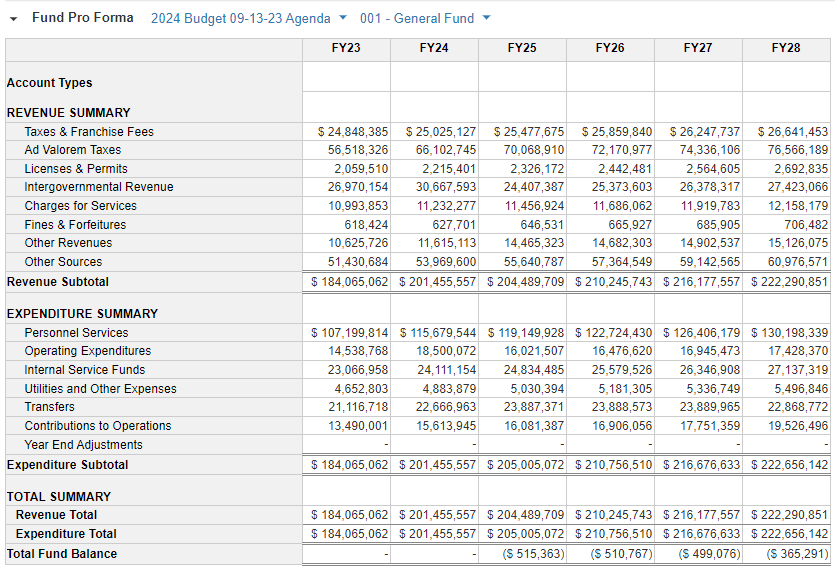

Five-Year Fund Proformas – Revenues and Expenses by Fund

By clicking on the fund titles below, a five-year proforma of revenues and expenditures will display for each. The proforma includes the budget for the prior year, FY23, the adopted budget for FY24, and projections for the remaining years, FY25 – FY28. The five-year forecast is a means of facilitating long-range and financial planning. Below each proforma is a summary of FY24 budget highlights and a link to see an additional view of the fund in OpenGov.

See additional views of FY24 budget in OpenGov

See additional detail of the Five-Year Fund Pro Formas.

Estimated revenues and expenditures for FY24-FY28 reflect revenue projections and current expenditure levels. The latter years of the pro forma indicate how expected trends applied to current estimates will shape future budget planning.

Budget Highlights

FY24

- The adopted FY24 General Fund budget includes a $9.5 million increase to the Tallahassee Police Department’s budget funded by a millage rate increase from 4.100 to 4.4500, along with an increase in taxable property value of 7.8% to $15.6 billion.

- Contributions from utilities increased with CPI by 5% for FY24 based on City policy. At $53 million, contributions make up 26.3% of General Fund revenues, adding $2.5 million in revenues.

- In FY24, the budget includes $6.7 million in American Recovery Plan Act (ARPA) revenue claims. FY24 is the final year to use the remaining ARPA funds.

- The FY24 budget includes 20 new police officer positions, one new position in the Inspector General department, and a new position in the Ethics department.

FY25-28

- Future revenue projections are conservative based on prior trends. As the annual budget is developed, estimates are updated closer to budget approval. Creating new options for revenue generation is limited by statute, and existing, significant revenue sources are sensitive to unforeseen economic impacts. FY25 revenues reflect the reduction of $6.7 million as the last of the ARPA grant will be fully expended in FY24.

- Personnel costs for future years reflect a 3% growth through FY28. However, the estimated increase would be adjusted if inflation and tight labor market conditions extend beyond FY24.

- Operating costs from FY25 to FY28 are escalated by 2.8% overall.

- Transfer estimates include debt service, insurance reserve reimbursement, operating project transfers, and the annual transfer for capital projects. Debt Service transfers reflect a $1.7 to $3.9 million increase between FY25 and FY28; however, estimates will be adjusted as the amount and timing of future borrowing is developed.

- Estimates for FY25-FY28 do not include estimated increases in the number of positions in the fund—departments review service needs and staff levels during the annual budget development process.

The General Fund for FY24 totals $201.4 million and includes the Tallahassee Police Department, Parks & Recreation, Public Infrastructure (roads and street construction and maintenance), Community Housing and Human Services, and other non-utility services. The fund also contributes to StarMetro and the Consolidated Dispatch Agency, transfers the ad valorem share due to the community redevelopment agencies, and transfers funding for capital projects and debt service.

See additional views of FY24 budget in OpenGov

See additional detail of the Five-Year Fund Pro Formas.

Estimated revenues and expenditures for FY24-FY28 generally reflect revenue projections and current expenditure levels escalated by a CPI factor and indicate how expected trends applied to current estimates will shape future budget planning.

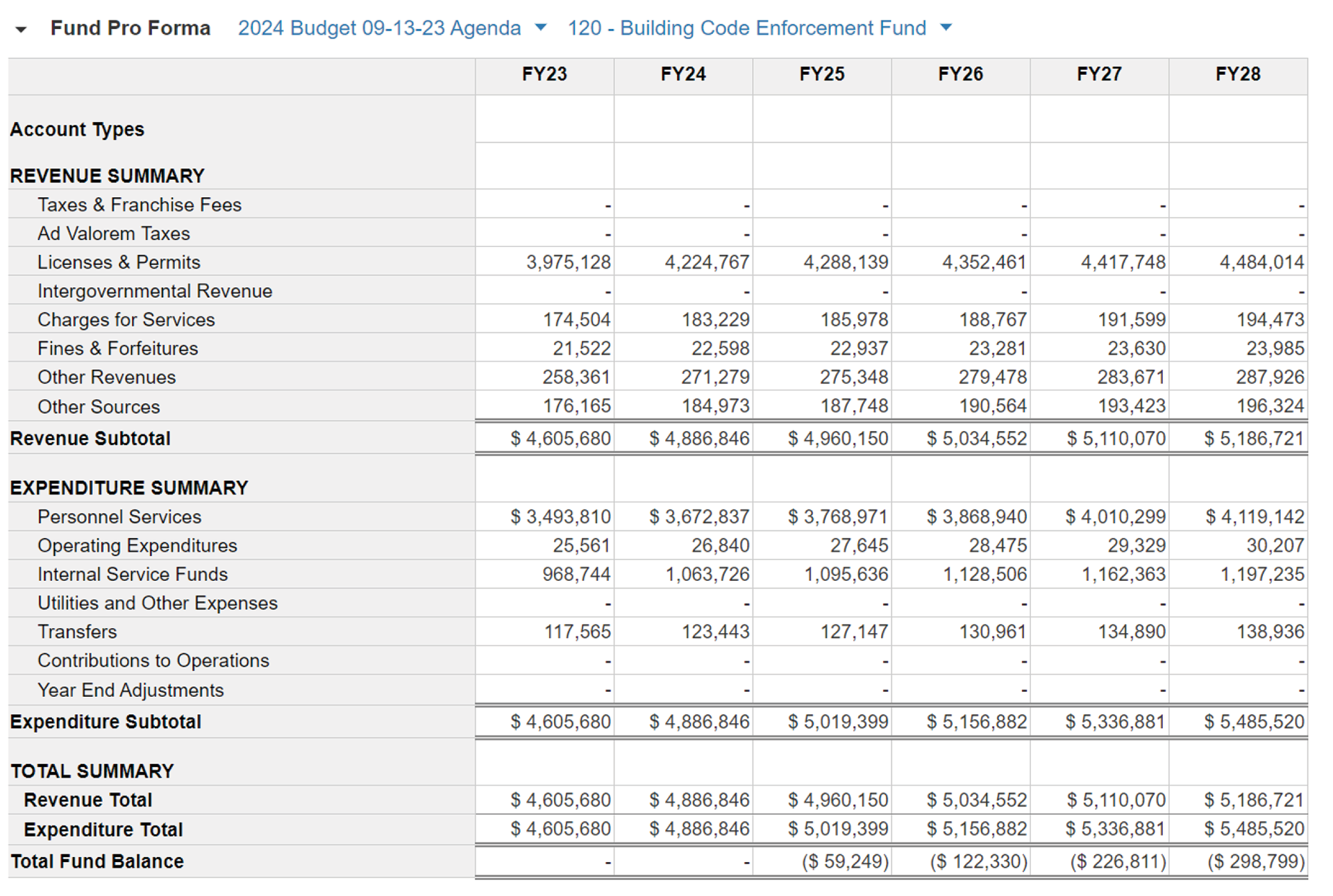

Budget Highlights

FY24

- The fund is self-sustaining, with fees from increased activities in a given year expected to support the fund over several years of service. Fees were increased effective October 1, 2022, to ensure full cost recovery for FY23. At the same time, an annual rate increase tied to CPI effective each year on October 1 was approved for consistency with rate policy across other enterprise funds and to provide incremental revenue increases as costs increase over time. However, for FY24, there will be no CPI-related rate increase due to Senate Bill 250, which was signed into law in June 2023. The bill prevents local governments located in areas designated in the FEMA disaster declarations for Hurricanes Ian and Nicole from raising building inspection fees past their current rates until October 1, 2024..

FY25-28

- Revenues are projected at an escalator of 1.5% for FY25-28, although revenues tend to vary significantly over time due to demand and the Consumer Price Index

- Personnel costs escalated by less than 4% through FY28, however inflation and a tight labor market may require higher pay increases to remain an employer of choice.

- Operating costs are escalating by 1.5% overall.

The Building Inspection Division operates as a separate enterprise fund established to account for all activities related to enforcing the City’s building inspection regulations. The fund provides for the enforcement and implementation of the Florida Building Code.

See additional views of FY24 budget in OpenGov

See additional detail of the Five-Year Fund Pro Formas.

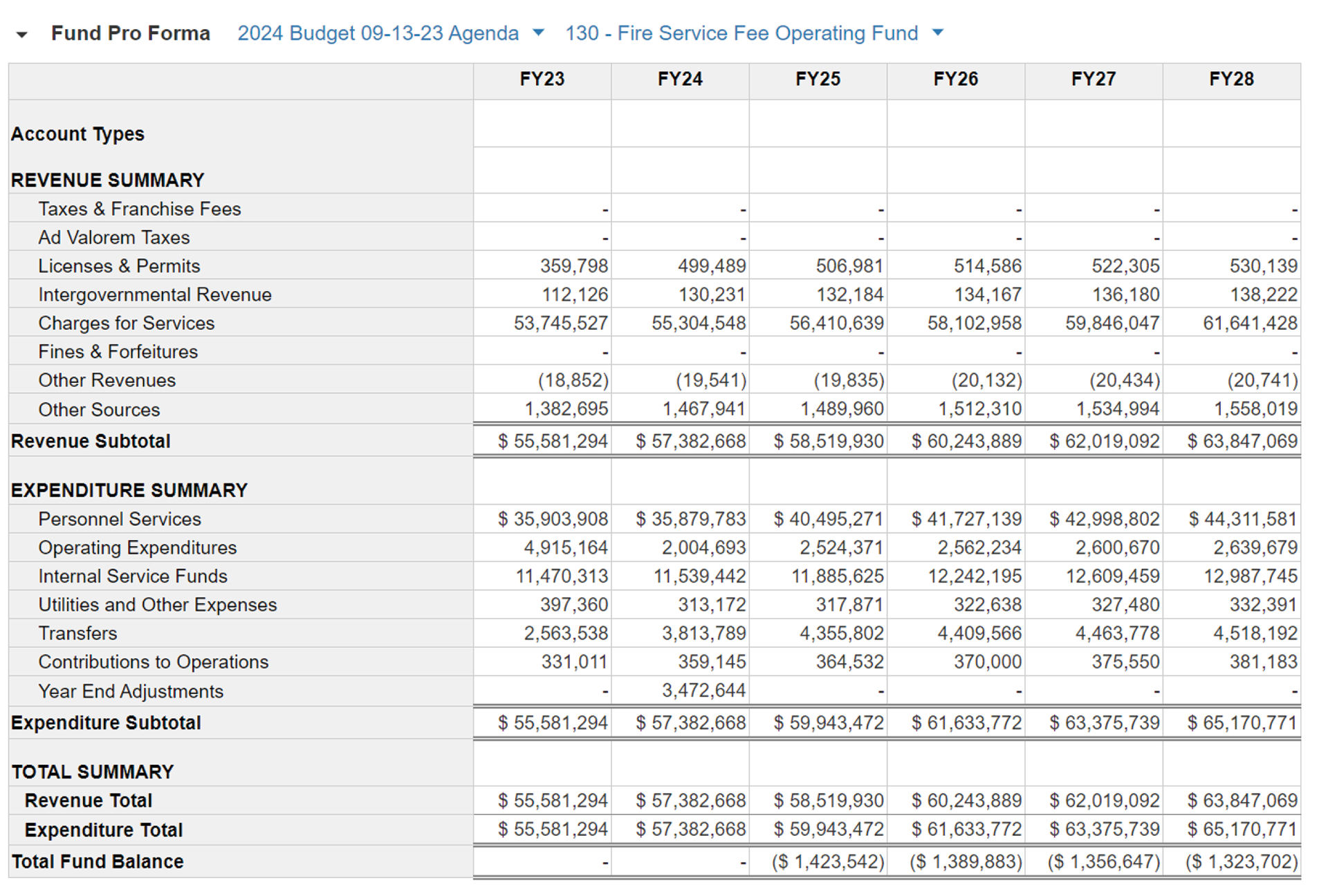

Estimated revenues and expenditures for FY24-FY28 generally reflect revenue projections and current expenditure levels escalated by a CPI factor and indicate how expected trends applied to current estimates will shape future budget planning.

Budget Highlights

FY24

- The Tallahassee Fire Department will continue to provide outstanding services to the community at their current staffing level.

- The City and County in FY23 conducted a joint rate study and new rates have been approved for FY24.

- The current collective bargaining agreement between the City and the International Association of Fire Fighters expired at the end of FY23 and negotiations for a new contract are underway. A new agreement will affect personnel costs for future years.

FY25-28

- Personnel costs for the upcoming Fire Station 17 are budgeted beginning in FY25.

The Tallahassee Fire Department (TFD) provides the City of Tallahassee and Leon County with quality fire suppression; specialized hazardous material response; emergency management; facilities security; focused urban search and rescue; dedicated technical rescue; superior vehicle extrication; high-quality emergency medical care; fire safety code compliance review and enforcement; and varied public education services. Beyond Leon County, the department also provides emergency response via mutual aid to communities in the surrounding area. Within TFD, Emergency Medical Technicians (EMTs) are trained in Basic Life Support (BLS) measures for trauma care, cardiac and stroke care, CPR, advanced first aid, childbirth, and basic medication administration. TFD's paramedics are ALS certified and responsible for managing the emergency medical scene according to protocol and directing operations inside the medical transport unit as it travels to the hospital.

See additional views of FY24 budget in OpenGov

See additional detail of the Five-Year Fund Pro Formas.

Estimated revenues and expenditures for FY24-FY28 generally reflect revenue projections and current expenditure levels escalated by a CPI factor and indicate how expected trends applied to current estimates will shape future budget planning.

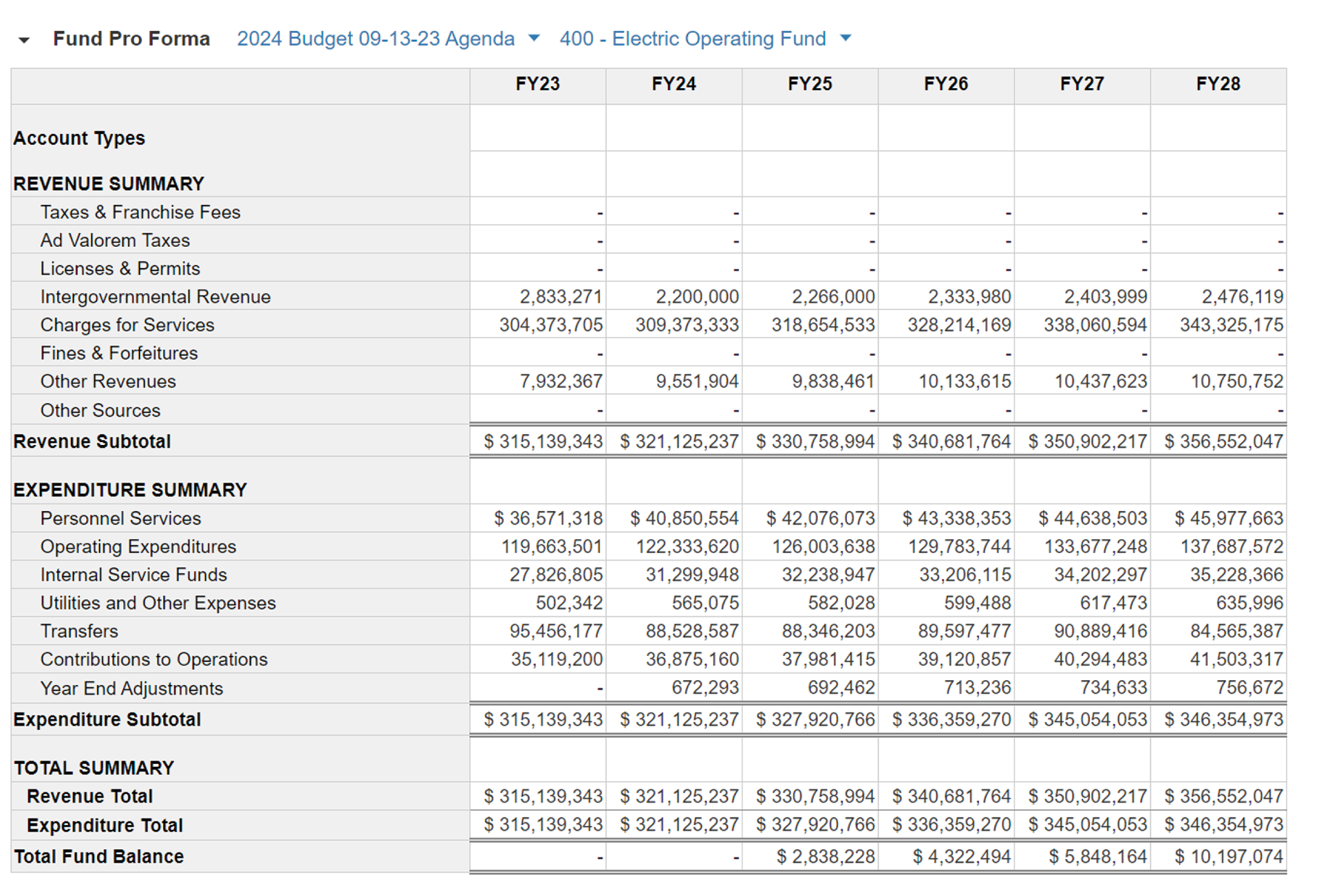

Budget Highlights

FY24

- The department will continue to explore expanding its’ solar generation capacity.

- The Electric Utility develops 10-year sales forecast annually to use in the annual budget process.

FY25-28

- The Electric Utility continues to invest in the current electric grid by enhancing funding in tree trimming and systemwide switch inspection and replacement.

- There is also a focus on enhancing transmission reliability and import capability through additional bulk power system interconnections.

- The department continues to look to the future to develop and implement the City’s Clean Energy Plan.

- Continued funding of pilot EV charging stations program and installation of new stations at key locations throughout the City.

The Electric Utility serves over 120,000 customers in a 221-square mile service territory. It is the fourth-largest municipal electric utility in Florida and the 27th-largest of over 2,000 municipal systems in the United States. The utility is comprised of six major divisions: Finance and Administration, Power Delivery, Energy Supply, System Operations, System Compliance, and System Integrated Planning. The Electric Utility develops a 10-year sales forecast annually to use in the annual budget process. This sales forecast is based on a variety of inputs, such as heating and cooling degree days, economic, and population growth, the weather being the most variable driver. As the year progresses, actual sales are used to guide the operational decisions of the utility.

See additional views of FY24 budget in OpenGov

See additional detail of the Five-Year Fund Pro Formas.

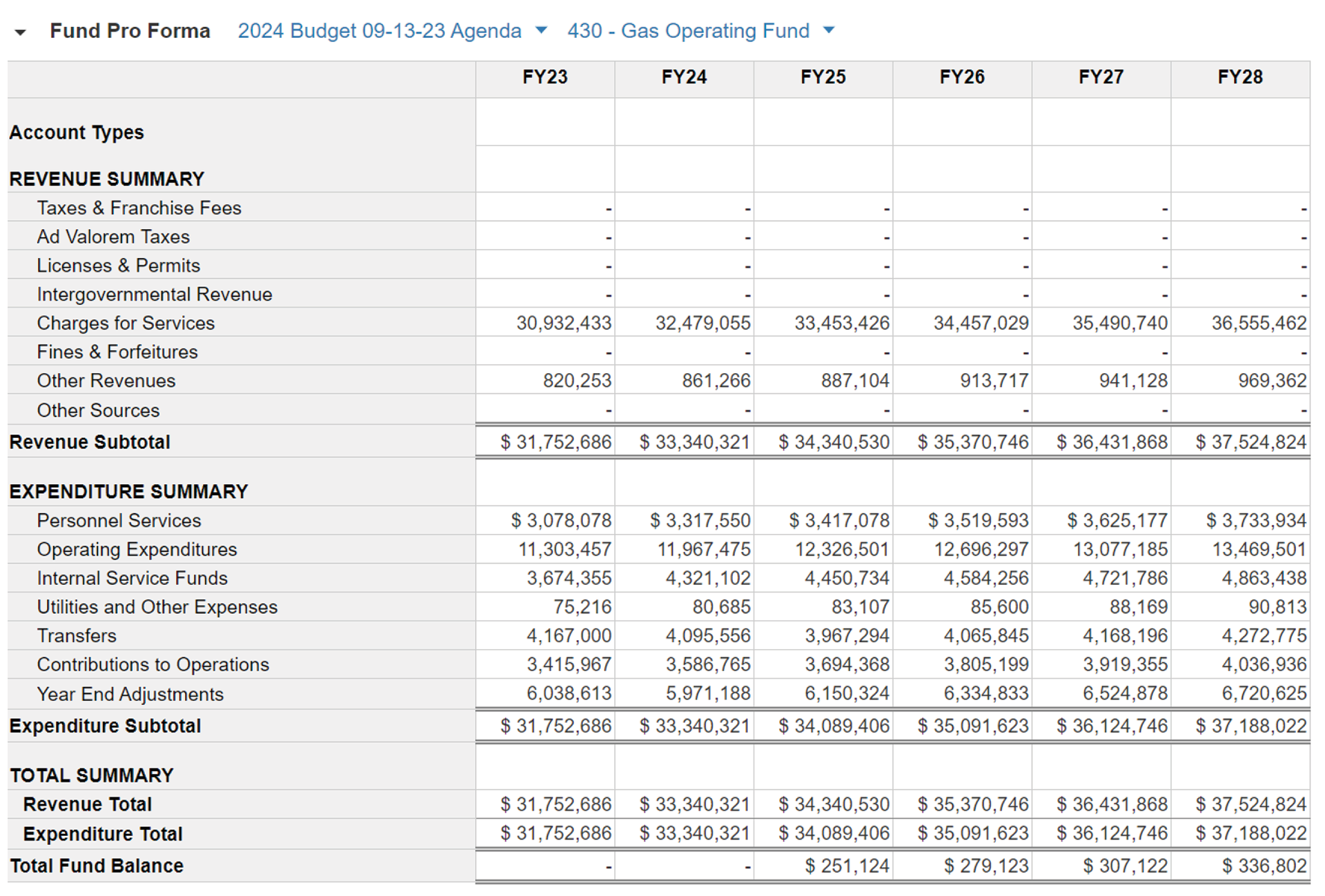

Estimated revenues and expenditures for FY24-FY28 generally reflect revenue projections and current expenditure levels escalated by a CPI factor and indicate how expected trends applied to current estimates will shape future budget planning.

Budget Highlights

FY24

- · The Gas utility continues to receive a high grade from its customers in satisfaction surveys. The Commission passed a new gas-hit-line fine in FY23, with most of the revenue to be used for community education programs. Education and outreach will help prevent future line damage, reducing costs and incidents involving the Utility’s infrastructure.

FY25-28

- The department continues to look to the future to develop and implement the City’s Clean Energy Plan.

- Further implementation of the Utility’s Methane Reduction Program.

The City of Tallahassee's Natural Gas Utility has provided clean, safe, economical and reliable natural gas to residents and businesses in a growing service area since 1956. The utility safely provides natural gas energy through 965 miles of underground gas mains that serve over 34,000 customers in the Leon, Gadsden, and Wakulla County areas. The highly trained staff works to ensure the integrity and dependability of the distribution system, and to assist customers with energy conservation and cost savings through natural gas use.

See additional views of FY24 budget in OpenGov

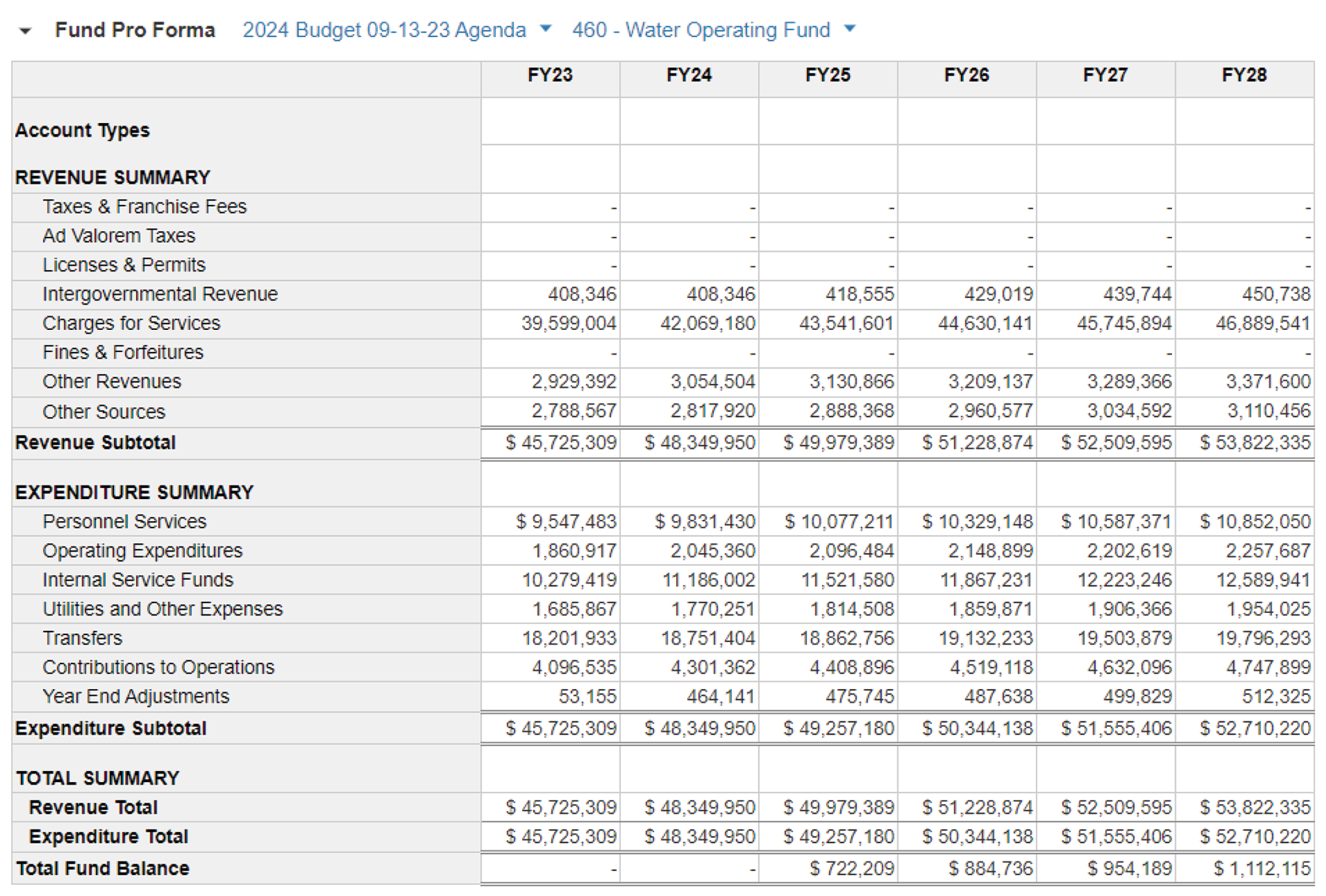

See additional detail of the Five-Year Fund Pro Formas.

Estimated revenues and expenditures for FY24-FY28 generally reflect revenue projections and current expenditure levels escalated by a CPI factor and indicate how expected trends applied to current estimates will shape future budget planning.

Budget Highlights

FY24

- Per City Ordinance, and consistent with the parameters of the most recent rate study, water rates were increased by a CPI factor of 5% on October 1, 2023. The total impact to the average residential utility bill (6,000 gallons) equates to $1.24 per month.

- In FY23, operating expenditures were redistributed based on a historical three-year average to accurately reflect anticipated costs. These were recalculated for FY24 to account for inflation and targeted material costs, resulting in an overall 9.9% increase. The utility is scheduled to undertake a rate study in FY24.

- The Renewal, Replacement, and Improvement (RR&I) transfer for the capital improvements of Water infrastructure increased to $6.8 million, up from $6.4 million in FY23.

FY25-28

- Assumptions for rate revenues include modest customer growth of 1%, and CPI set at 3.5% for FY25 and 2.5% from FY26 through FY28.

- Operating expenses are estimated to increase by 2.5% through FY28.

- Commitment to capital investments includes a future borrowing in FY24 and a 5% average increase per year in the RR&I transfer through FY25. Updates to future capital contributions will be addressed in the upcoming rate study.

See additional views of FY24 budget in OpenGov

See additional detail of the Five-Year Fund Pro Formas.

Estimated revenues and expenditures for FY24-FY28 generally reflect revenue projections and current expenditure levels escalated by a CPI factor and indicate how expected trends applied to current estimates will shape future budget planning.

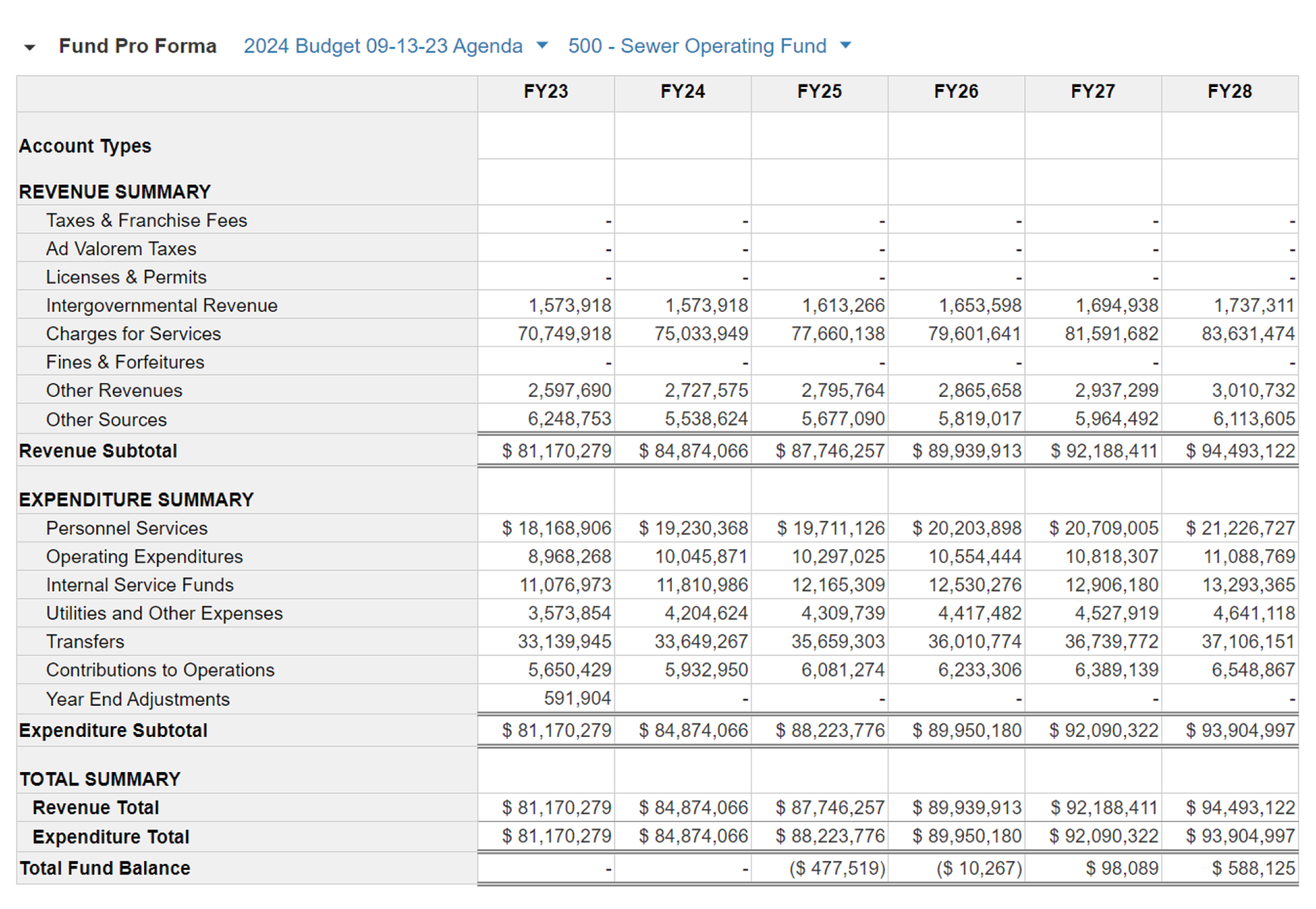

Budget Highlights

FY24

- Per City Ordinance, and consistent with the most recent rate study parameters, sewer rates were increased by a CPI factor of 5% on October 1, 2023. The total impact to the average residential utility bill (5,000 gallons) equates to $3.01 per month.

- In FY23, operating expenditures were redistributed based on a historical three-year average to accurately reflect anticipated costs. These were recalculated for FY24 to account for inflation and targeted chemical costs, resulting in an overall 12% increase. The utility is scheduled to undertake a rate study in FY24.

- The Renewal, Replacement, and Improvement (RR&I) transfer for the capital improvements of wastewater infrastructure increased to $12.3 million, up from $11.7 million in FY23.

FY25-28

- Assumptions for rate revenues include modest customer growth of 1% and CPI set at 3.5% for FY25 and 2.5% from FY26 through FY28.

- Operating expenses are estimated to increase by 2.5% through FY28.

- Commitment to capital investments includes a future borrowing in FY24 and a 3.3% average increase per year in the RR&I transfer through FY25. Updates to future capital contributions will be addressed in the upcoming rate study.

See additional views of FY24 budget in OpenGov

See additional detail of the Five-Year Fund Pro Formas.

Estimated revenues and expenditures for FY24-FY28 generally reflect revenue projections and current expenditure levels escalated by a CPI factor and indicate how expected trends applied to current estimates will shape future budget planning.

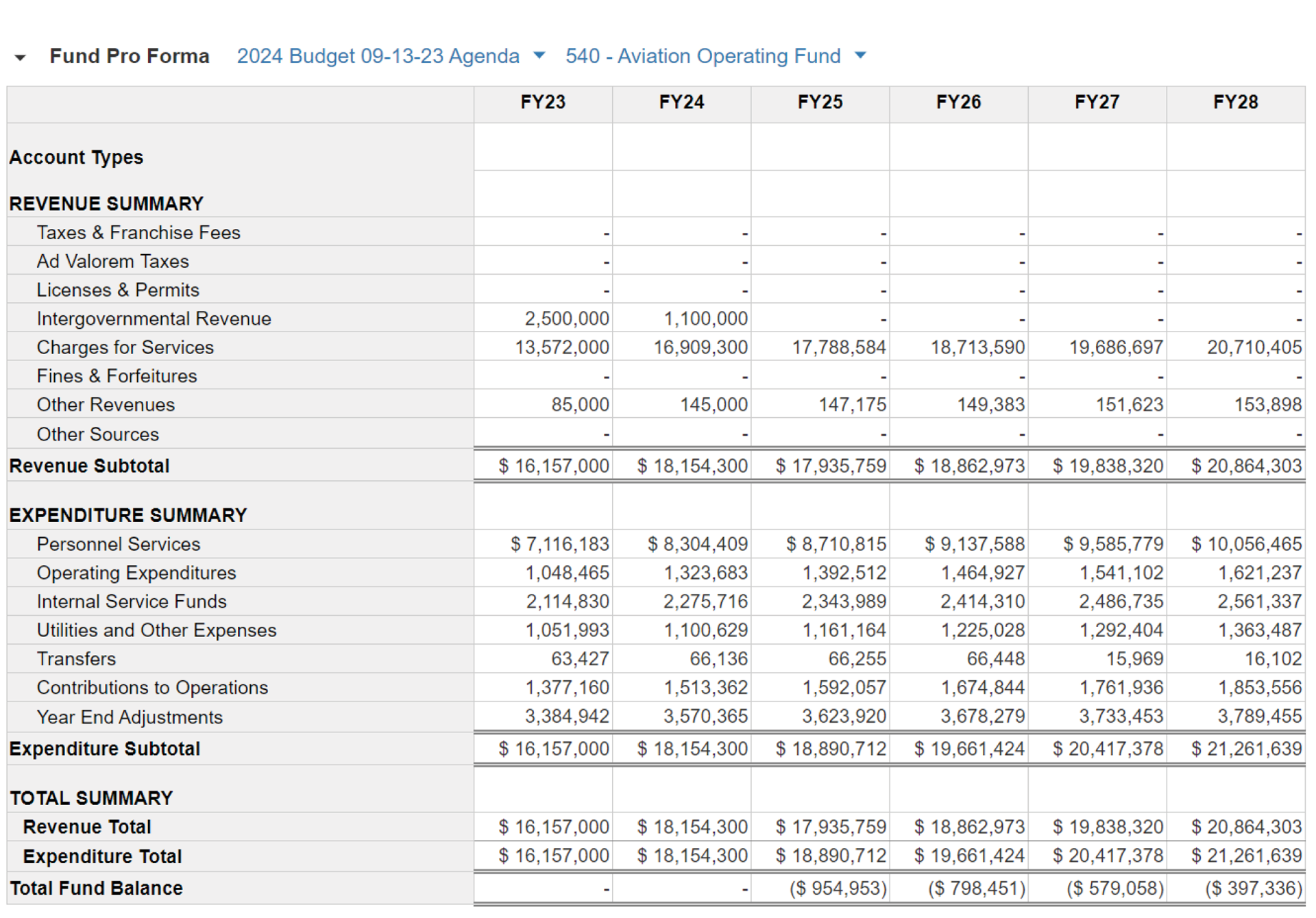

Budget Highlights

FY24

- Total revenues have increased over the past three years, including a $2.0 million increase in revenue this FY. The increase is primarily due to a return to pre-pandemic airport traffic, including increases in Rental Car and Parking Lot Revenues.

- The airport continues to receive considerable grant funding for capital projects.

- Expenses are set to increase by $2.0 million from FY22 to FY23 due to a rise in overall operational needs and RR&I investments.

- FTE employees have increased by 3 to 57 since FY19.

- Major Capital projects are ongoing at the airport, including the International Processing Facility, Terminal Modernization, Parking Facility improvements, and Taxiway Rehabilitation.

FY25-28

- Planning for future taxiway rehabilitation projects, along with additional facility capital improvements.

- The Tallahassee International Airport (TLH) is well on its way to establishing a new Foreign Trade Zone (FTZ) that will align with the opening of the International Processing Facility, currently slated for completion third quarter 2024. An FTZ is a secure, federally designated location in the United States that is considered to be outside of US Customs territory for tariff purposes. If approved by the U.S. Foreign-Trade Zones Board, TLH’s new Zone will span an eleven (11)-county Service Area between the I-75 corridor and Panama City. FTZs can provide numerous economic benefits and supply chain efficiencies to Zone users. TLH’s new Zone will bolster the region’s manufacturing sector, encourage international commerce, create jobs, stimulate the economy and increase the global competitiveness of the Northwest and North Central Florida Region.

- The Bipartisan Infrastructure Bill estimates the airport to receive roughly $16 million over the next five years (FY23 – FY27).

See additional views of FY24 budget in OpenGov

See additional detail of the Five-Year Fund Pro Formas.

Estimated revenues and expenditures for FY24-FY28 generally reflect revenue projections and current expenditure levels escalated by a CPI factor and indicate how expected trends applied to current estimates will shape future budget planning.

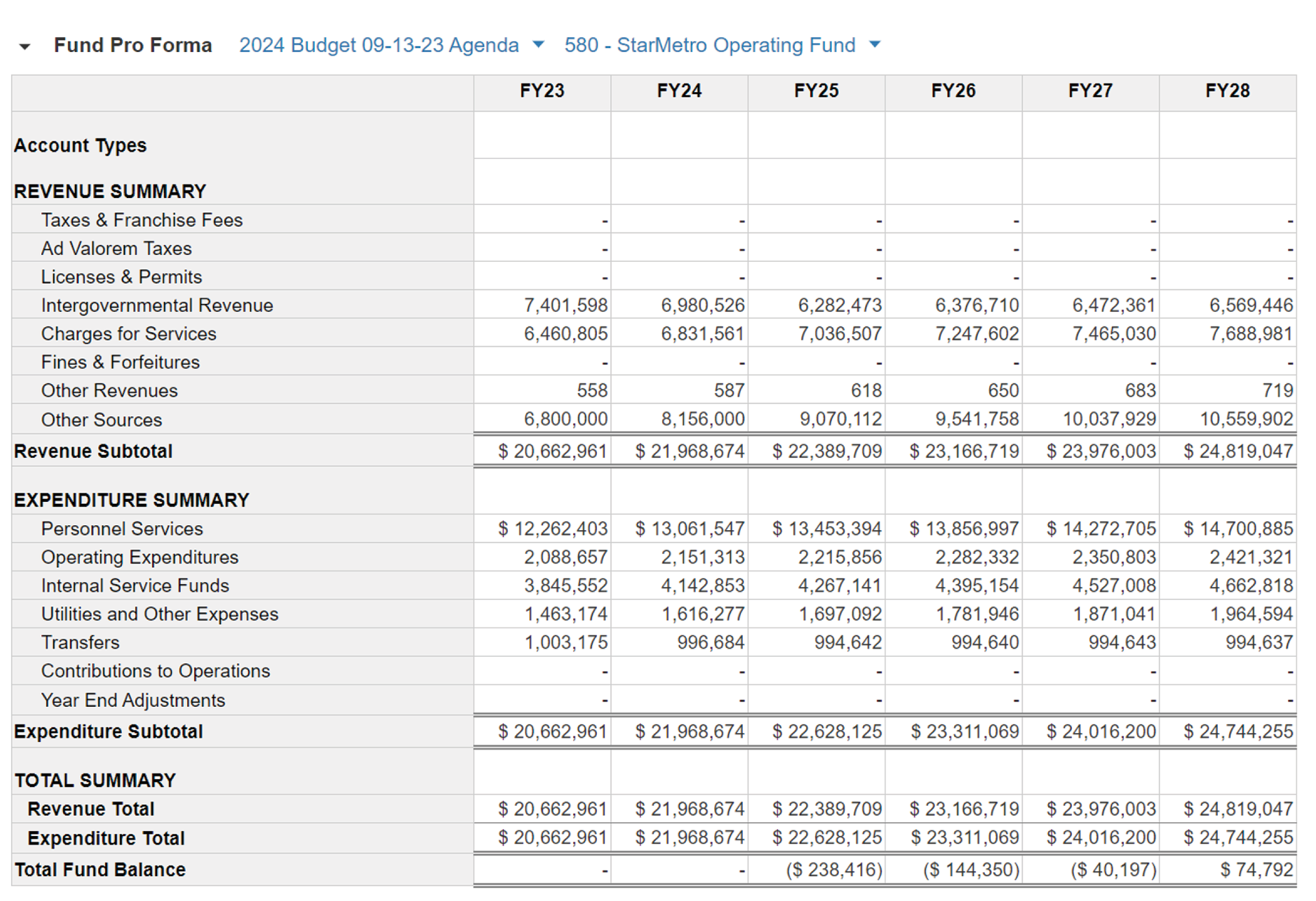

Budget Highlights

FY24

- The FY24 budget totals $21.9 million, which is $1.3 million, or 6%, higher than FY23.

- The projected grant fund revenue of $6.9 million is a decrease from last year’s $7.4 million due to the use of one-time grant funding in the prior year.

- Charges for services are estimated to increase by $370,000 in FY24. In FY24, FSU bus contract revenue made up $5.5 million of the projected $6.8 in service charges.

- The transfer from the General Fund increases to $5 million from the prior year’s $3.8 million, and a growth factor has been added to the transfer from Gas Tax funds.

- StarMetro has 143.50 full-time equivalent (FTE) and 54 temporary employees.

FY25-28

- Future budget projections assume a steady annual increase in ridership and fare cash and a steady decrease in Gas Tax revenue.

- Expenses for fixed route and Dial-A-Ride services are expected to increase yearly due to expected salary increases. The cost of fuel is a factor but is challenging to forecast.

- The General Fund contribution will increase to $5 million in FY24, with the option to increase it to $5.8 million in FY25.

- The department will continue to leverage grant funds and work with Fleet Management to purchase electric buses. The target is to make the conversion to electric by 2035.

- StarMetro was awarded $20 million in grant funds to construct the South Side Transit Center (SSTC), with $15 million from the US Department of Transportation, $1 million from the State Legislature, and $1 million from Blueprint. The City’s match is $3 million.

- Blueprint funding of $612,5000 will be used to improve and enhance bus stops each year.

The City has operated StarMetro, a public transit system, since December 1973. StarMetro provides fixed route and special transportation services under the Americans with Disabilities Act (ADA) provisions and serves as the Community Transportation Coordinator (CTC) for Leon County. Public transportation services include weekday cross-town routes as well as university routes. StarMetro also provides individually scheduled per-request (para-transit) transportation to senior, disabled, and low-income customers in Tallahassee and Leon County.

StarMetro heavily relies on personnel to accomplish its mission. StarMetro's primary goal is to meet the community's service needs within budgetary constraints by monitoring on-time performance and ridership levels monthly and quarterly, daily and weekly staffing levels.

StarMetro's vehicles and facilities comply with rules and regulations in the State of Florida Uniform Traffic Control Laws, Florida Administrative Code, Federal Motor Vehicle Safety Standards, and the Federal Transit Administration Policies and Procedures.

StarMetro regularly uses grant funds for capital projects and operating expenses. A combination of CARES Act, American Rescue Plan, Urbanized Area Formula Grants, and FL Department of Transportation (FDOT) grants have provided funding for services in recent years. StarMetro will continue to leverage grant funding opportunities to maintain high-quality transit services.

See additional views of FY24 budget in OpenGov

See additional detail of the Five-Year Fund Pro Formas.

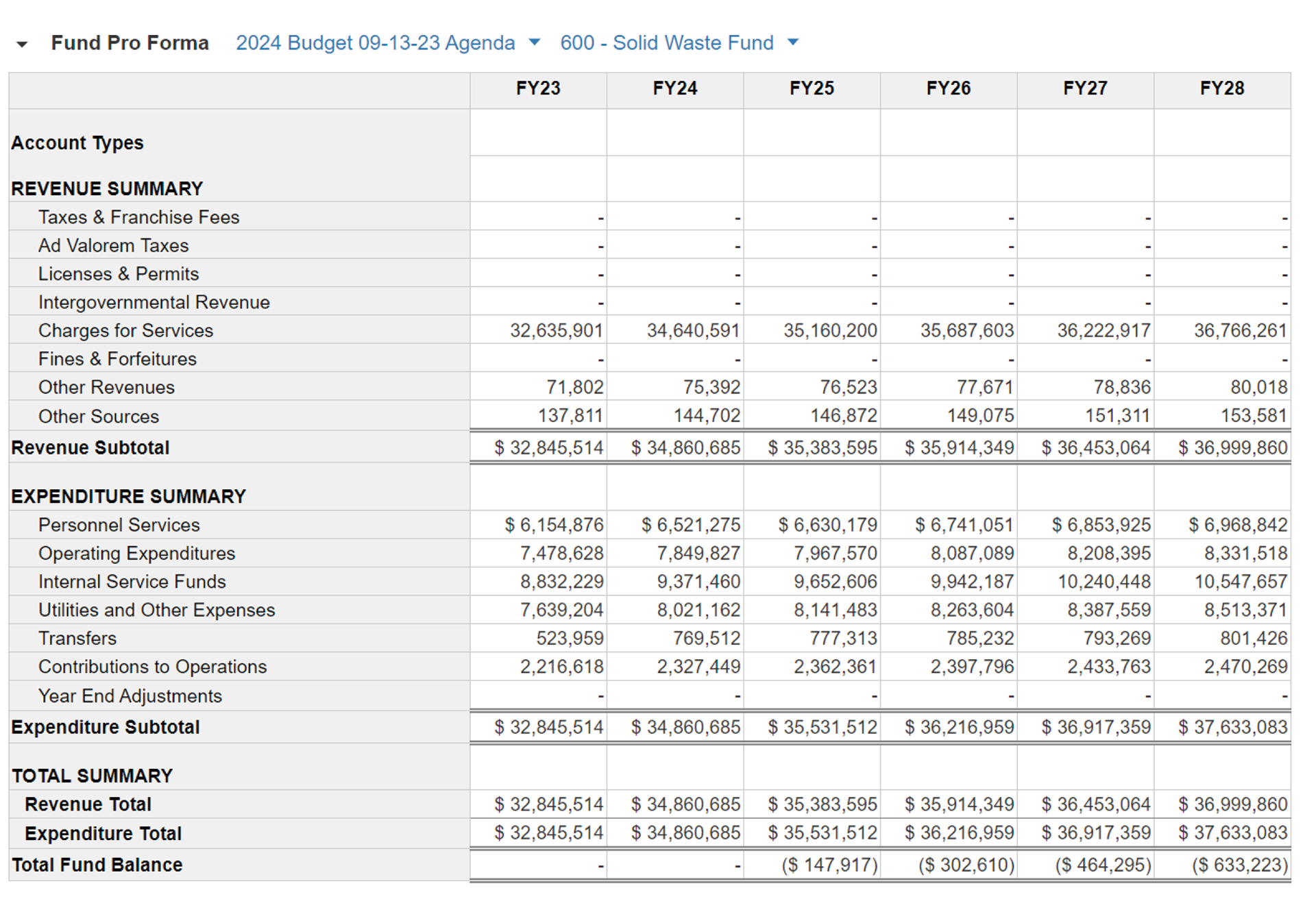

Estimated revenues and expenditures for FY24-FY28 generally reflect revenue projections and current expenditure levels escalated by a CPI factor and indicate how expected trends applied to current estimates will shape future budget planning.

Budget Highlights

FY24

- • The fund is self-sustaining, with monthly service charges paying for services.

- • Solid Waste rates are reviewed every three to four years to ensure cost recovery over the planning period. A rate study was conducted in FY23, which culminated in the City Commission approving a new schedule of solid waste fees for FY24. Residential rates for solid waste collection have increased by the Consumer Price Index, while commercial rates have increased by 8.31%.

FY25-28

- Revenues should steadily increase over the next four years due to the rate increase

- Expenditures are projected at an escalator of 1.5% for FY25-28

- Personnel costs escalated by less than 2% through FY28, however inflation and a tight labor market may require higher pay increases to remain an employer of choice.

As part of the Community Beautification and Waste Management Department, the Solid Waste Fund provides garbage, recyclable materials, bulk, and yard waste collection for all residential customers citywide, and garbage and recyclable materials collections for commercial customers. Currently, the City serves 51,572 residential, 25,308 commercial, and 1,835 commercial recycling service points.

See additional views of FY24 budget in OpenGov

See additional detail of the Five-Year Fund Pro Formas.

Estimated revenues and expenditures for FY24-FY28 generally reflect revenue projections and current expenditure levels escalated by a CPI factor and indicate how expected trends applied to current estimates will shape future budget planning.

Budget Highlights

FY24

- Operating revenues and expenses were adjusted by CPI at 6.5% for FY24 and included a $3.8 million transfer to the Stormwater Renewal, Replacement, and Improvement (RR&I) Fund.

- In FY23, operating expenditures were redistributed based on a historical three-year average to reflect anticipated costs more accurately. These were recalculated for FY24 to account for inflation and targeted costs, resulting in an 11.2% increase.

- The Stormwater On-Site Mitigation Loan Program was increased by $150,000.

FY25-28

- Assumptions for rate revenues include modest customer growth of 1% and CPI set at 3.5% for FY25 and 2.5% from FY26 through FY28.

- Operating expenses are estimated to increase by 2.5% through FY28.

- Emphasis on maximizing the RR&I transfer through reducing operating expenses will continue to be monitored each year.

See additional views of FY24 budget in OpenGov

See additional detail of the Five-Year Fund Pro Formas.

Estimated revenues and expenditures for FY24-FY27 generally reflect revenue projections and current expenditure levels escalated by a CPI factor and indicate how expected trends applied to current estimates will shape future budget planning.

Budget Highlights

FY24

- In FY24, the Golf Department will continue to provide outstanding services to the community at their current staffing level.

- Revenues are expected to increase slightly in FY24 due to an increase in membership rates and greens fees.

- Total expenditures at Hilaman are also expected to be slightly higher in FY24 due to the consistent amount of rounds played and the increase in cost of goods.

- Golf course management plans to remodel the driving range at Hilaman in FY24.

FY25-28

- With an increase in rates. steady revenue growth is expected over the next four years.

See additional views of FY24 budget in OpenGov

See additional detail of the Five-Year Fund Pro Formas.

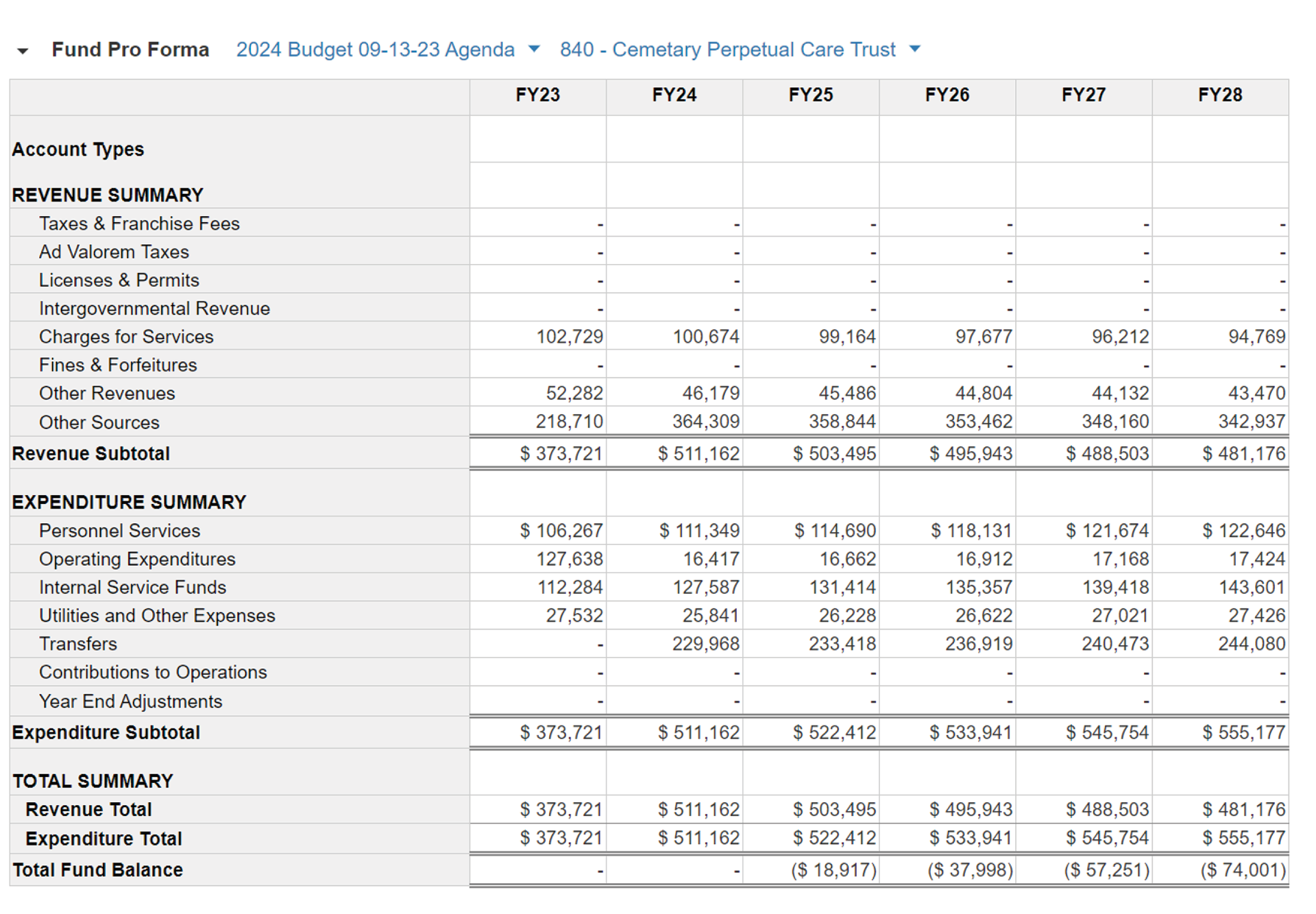

Estimated revenues and expenditures for FY24-FY28 generally reflect revenue projections and current expenditure levels escalated by a CPI factor and indicate how expected trends applied to current estimates will shape future budget planning.

Budget Highlights

FY24

- Staff continues to monitor the Perpetual Care Trust Fund (PCTF) drawdown by tracking maintenance costs, evaluating the current inventory of burial spaces, and engaging in a burial plot buyback program to provide additional spaces to replenish the trust fund.

FY25-28

- Subject to estimates of future sales of grave spaces and maintenance expenditures, it is projected that the PCTF will be funded through FY29.

3.1 Financial Schedules

This section contains links to the OpenGov transparency portal that the City of Tallahassee uses to share

financial and budgetary information. The strength of the platform lies in the power of the viewer to see

the budget from any

angle. Select the links below as starting points.

3.2 Fund and Reserve Balances

Click here for the Capital Fund Balance Report

Click here for the Schedule of Reserves

| Fund |

FY23 Amended

Budget |

FY23 Actual

Revenue |

FY23 Actual

Expense |

FY23 Actual

Variance |

Year-End Closing Action |

| General |

$184,212,672 |

$183,338,111 |

$(182,720,745) |

$617,366 |

Transfer to Deficiencies Fund per policy |

Building

Inspections |

4,605,680 |

5,315,827 |

(4,648,056) |

667,771 |

Transfer to Building Inspection Reserve Fund 121 per State Law. |

|

| Fire |

55,639,515 |

54,861,845 |

(53,120,134) |

1,741,711 |

Transfer to Fire Operating Reserves per policy. |

| Electric |

318,425,773 |

320,777,288 |

(320,777,288) |

- |

No action. |

| Gas |

31,796,493 |

31,768,011 |

(27,642,278) |

4,125,733 |

Transfer to Gas Operating Reserve and Gas RR&I per policy. * |

| Water |

45,809,545 |

48,164,195 |

(45,571,700) |

2,592,495 |

Transfer to Water Operating Reserve and Water RR&I per policy. * |

| Sewer |

81,947,490 |

86,310,837 |

(86,308,145) |

2,692 |

Transfer to Sewer Operating Reserve per policy. * |

| Aviation |

16,216,838 |

17,937,073 |

(17,937,073) |

- |

No action. |

| StarMetro |

20,439,340 |

19,040,519 |

(19,040,519) |

- |

No action. |

| Solid Waste |

32,617,700 |

34,406,446 |

(34,178,999) |

227,447 |

Transfer to Solid Waste Operating Reserve per policy. |

| Stormwater |

20,975,730 |

21,574,708 |

(20,492,157) |

1,082,556 |

Transfer to Stormwater RR&I per policy. * |

| Golf |

1,273,494 |

1,540,863 |

(1,389,818) |

151,045 |

Transfer to Golf RR&I per policy. |

| Cemetery |

373,721 |

180,515 |

(459,193) |

(278,678) |

Transfer from Cemetary Perpetual Care Trust Fund per policy. * |

| Donations |

93,656 |

138,301 |

(75,585) |

62,716 |

Transfer to Donations per policy. |

* Tansfers to RR&I provide funding for infrastructure investment

FY23 Closeout Statements by Fund

The final closeout statement for each fund is presented below with information on service levels, year-end amendments for balancing, and further monitoring for FY24.

General Fund

The General Fund ends FY23 at $183.3 million with a surplus of $617,366. This positive financial result reflects the Commission’s leadership, the strength of the management team, and City employees’ dedication to providing high-quality services within the resources available. These results also serve objective 3D in the City’s Strategic Plan, “Maintain the City’s strong financial standing and fiscal stewardship practices.” Per City Policy, the surplus will be transferred in to the Deficiencies Fund.

The General Fund funds 23 different service departments, and the two largest are the Tallahassee Police Department ($65.3 million) and Parks and Recreation ($28.8 million). These two departments comprise 52% of the General Fund. Other services in the General Fund include public infrastructure planning and engineering, community beautification and right-of-way maintenance, growth management, comprehensive planning, housing, community resilience, and others that support the community and the organization. Transfers from the General Fund for debt payments, capital project funding, and contributions to StarMetro, the Consolidated Dispatch Agency (CDA), and Community Redevelopment Funds (CRAs) total $35.8 million, 19.6% of the total budget. The budget closeout statement for the General fund is shown below:

General Fund Revenues

American Rescue Plan Act (ARPA)

On March 11, 2021, the American Rescue Plan Act (ARPA) was signed into law. It included $45.6 billion for eligible cities to respond to the COVID-19 emergency. ARPA provided federal funding to eligible cities to offset revenue loss in FY20 and the ongoing revenue loss resulting from the gap between pre-COVID revenue levels and anticipated growth and reduced post-COVID levels and growth. The U.S. Treasury issued guidance for expending these funds on May 10, and the City Commission approved a spending plan for the funds on May 19.

In FY23, $5.1 million in ARPA revenue loss funds were budgeted in the General Fund, and the final $6.7 million for the General Fund is budgeted in FY24.

In addition to funding for lost revenues, ARPA funds are providing $18 million over the next two years to address Commission priorities, including Affordable Housing, Community Resilience, homelessness, food insecurity, and small business support for those communities hardest hit by the economic impacts of COVID-19.

The following highlights results for other significant revenues in the General Fund:

- Property Taxes (Ad Valorem) - Due to the ability of property owners to receive a discount on their taxes if they pay early, the City budgets 95% of the total tax levy to allow for the resulting revenue reduction. The City collected $1.4 million more than budgeted in FY23. At $57.9 million, property taxes (Ad Valorem) support 31.6% of the General Fund Budget.